In the fiercely competitive world of half-ton trucks, performance is king. As enthusiasts and everyday drivers alike search for the optimum blend of power and capability, the focus shifts to the V8 half-ton trucks performance comparison. This year, the spotlight is on the titans of the towing landscape—the 2025 Ford F-150, the 2025 Chevy Silverado, and the 2026 Ram 1500 Hemi. Each model boasts its own unique strengths, vying for supremacy as they tackle the grueling Ike Gauntlet.

As we dive into this high-stakes showdown, we’ll explore which of these heavyweights truly reigns supreme in performance, efficiency, and overall towing capabilities, considering their engine options and how they influence truck purchasing decisions.

Towing Efficiency and Capabilities Insights

When assessing the towing capabilities and efficiency of the leading half-ton trucks, the competition between the Ford F-150, Chevy Silverado, and Ram 1500 is fierce. Each model offers unique features and specifications, making it vital for potential buyers to examine various performance metrics closely.

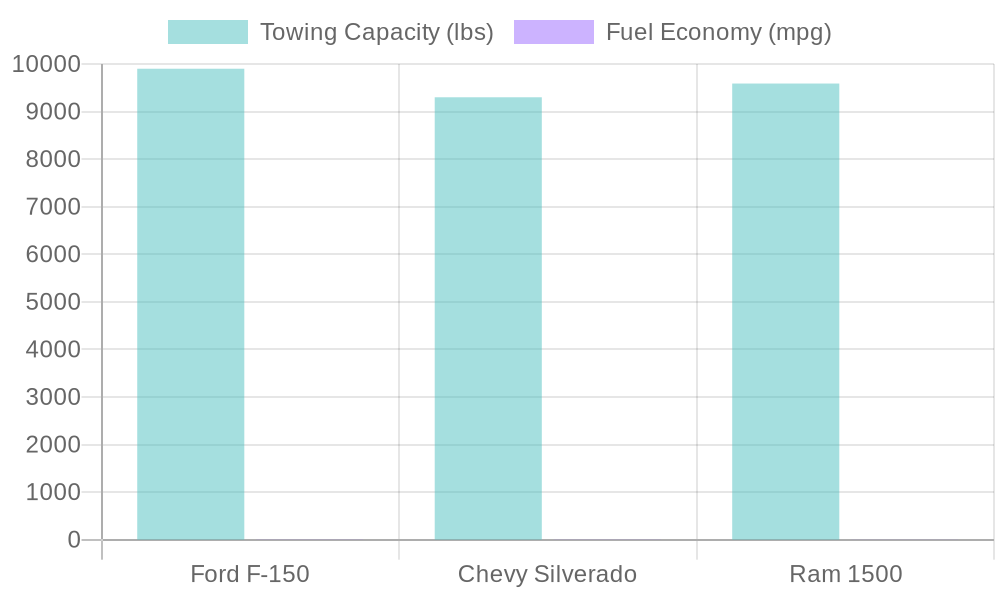

Ford F-150 exhibits superior towing efficiency with a maximum towing capacity of up to 9,900 pounds. This figure is complemented by its efficient performance on uphill and downhill grades, where it clocked an uphill time of 7 minutes and 57 seconds while achieving a fuel economy rating of 4.0 mpg. The Ford’s braking efficiency is underscored by its 9 brake applications, highlighting a robust braking system critical for maintaining safety during challenging towing conditions.

In comparison, the Chevy Silverado showcases a towing capacity of 9,300 pounds, slightly trailing the F-150. However, it excelled with an uphill time of 7 minutes and 52 seconds, indicating better agility in this test. Its fuel efficiency also leads with a rating of 4.2 mpg, while it has a higher brake application count at 12, which speaks to its braking responsiveness and overall towing efficiency under weight.

Meanwhile, the Ram 1500 stands with a towing capacity of 9,590 pounds, making it a competent choice for heavier hauling. However, it faced challenges during climbing tests, taking 8 minutes and 20 seconds to complete the ascent. The Ram’s fuel economy is less favorable at 3.7 mpg, with 11 brake applications, revealing that although it has great towing capability, it could improve its overall towing efficiency.

In essence, while the Ford F-150 leads in towing capacity and time efficiency, the Chevy Silverado stands out for its fuel economy and agility on hills. The Ram 1500, while strong in towing capacity, offers a combination of capabilities that may appeal to heavier loaders, but illustrates a need for enhanced efficiency tuning. This comparative analysis not only highlights the diversity in options available but also empowers consumers to choose based on specific towing efficiency and performance needs.

| Model | Towing Capacity | Brake Applications | Uphill Time | Fuel Economy |

|---|---|---|---|---|

| 2025 Ford F-150 | Up to 9,900 lbs | 9 | 7 min 57 sec | 4.0 mpg |

| 2025 Chevy Silverado | 9,300 lbs | 12 | 7 min 52 sec | 4.2 mpg |

| 2026 Ram 1500 | 9,590 lbs | 11 | 8 min 20 sec | 3.7 mpg |

Brake Applications and Uphill Performance

Testing brake applications and uphill performance reveals key findings, shedding light on the capabilities of these trucks under load. The 2025 Ford F-150 showcased commendable performance with 9 brake applications while tackling the steep incline in 7 minutes and 57 seconds. This not only indicates solid braking efficiency but also effective power delivery during uphill stretches.

Conversely, the 2025 Chevy Silverado required 12 brake applications—more than its competitors—but managed to ascend the hill quicker in 7 minutes and 52 seconds. While the Silverado has a more aggressive braking response, it also proves agile over steep terrains, possibly due to a favorable power-to-weight ratio during the uphill test.

Meanwhile, the 2026 Ram 1500, with 11 brake applications, struggled more than its competitors, taking 8 minutes and 20 seconds to complete the climb. While it has a higher towing capacity, its performance indicates it may require adjustments to optimize uphill capability, especially under heavy loads. Thus, understanding the relationship between brake applications and uphill climbing speed is crucial for evaluating a truck’s towing performance.

Evidence-Based Analysis of Fuel Economy

In analyzing the fuel economy figures for the 2025 Ford F-150, 2025 Chevy Silverado, and 2026 Ram 1500 Hemi, it’s essential to focus on how these figures relate to towing efficiency and the decisions made by consumers.

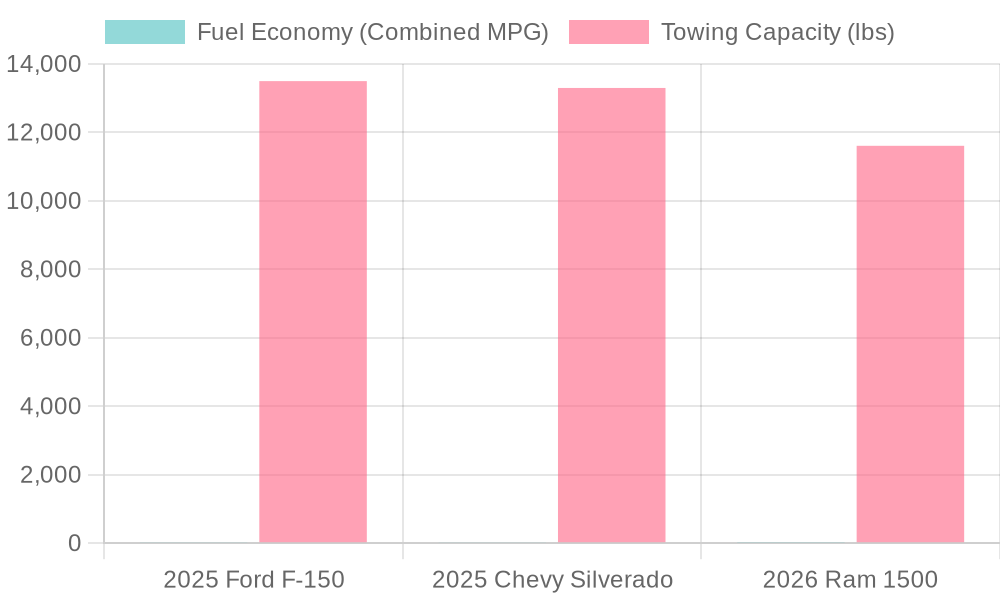

The Ford F-150 has several engine options with a towing capacity of up to 12,900 pounds. The 5.0L V8 variant offers a fuel economy rating of 19 MPG combined (16 city/24 highway), making it relatively efficient given its towing capability. However, when it comes to the fuel-efficient choices, the hybrid variant excels with a rating of 23 MPG combined. In typical towing scenarios where fuel consumption varies with load and terrain, the hybrid’s efficiency may translate to reduced operational costs, appealing strongly to users who frequently tow heavy loads.

The Chevy Silverado trailblazes further with its 2025 variants, offering the 3.0L Duramax diesel engine that can deliver a remarkable fuel economy of around 24 MPG combined while still achieving a towing capacity of approximately 13,300 pounds. This exceptional fuel efficiency makes the Silverado an attractive option for those needing both power and economy during long-haul towing.

The Ram 1500 Hemi, with a robust towing capacity of 12,750 pounds and a fuel economy of about 19 MPG combined (through various engine configurations), provides a balanced approach for consumers. However, its fuel efficiency, particularly under load, does not better the Silverado, placing the Ram in a competitive yet practical framework, especially among those who prioritize traditional gasoline engines over diesel.

Ultimately, fuel economy plays a pivotal role in consumers’ choices. Buyers often take into account how often they will use towing capacity and the associated fuel costs. Thus, trucks with hybrid or diesel options tend to gain traction in the market, appealing to users who prioritize fuel cost savings and environmental considerations without sacrificing performance. With real-world towing scenarios often not mirroring the advertised figures, practical efficiency under load becomes a critical metric influencing truck purchasing decisions.

Fuel Economy Analysis Visuals

To provide a clear comparison of fuel economy among the competing models, we have included two visual elements:

Visual representation showing the fuel economy comparison between the 2025 Ford F-150, 2025 Chevy Silverado, and 2026 Ram 1500.

Bar chart illustrating the fuel economy and towing capacity comparison for the Ford F-150, Chevy Silverado, and Ram 1500.

Summary of Competitive Features

In the towing market, each truck brings distinctive features that provide competitive advantages. The 2025 Ford F-150 leads with a towing capacity of up to 9,900 pounds and demonstrates solid performance with an uphill time of 7 minutes and 57 seconds.

The 2025 Chevy Silverado stands out for its fuel efficiency at 4.2 mpg and quick uphill performance, completing the climb in 7 minutes and 52 seconds while maintaining a towing capacity of 9,300 pounds.

Lastly, the 2026 Ram 1500 offers a substantial towing capacity of 9,590 pounds and solid braking performance, although it trails slightly in fuel economy and uphill speed. This variety allows consumers to select a truck that best meets their specific towing needs.

Conclusion

In conclusion, the comparison of the 2025 Ford F-150, 2025 Chevy Silverado, and 2026 Ram 1500 Hemi reveals a diverse landscape of options for consumers seeking powerful and efficient towing solutions. The Ford F-150 boasts a leading towing capacity of up to 9,900 pounds, paired with commendable performance metrics, making it an appealing choice for those prioritizing power and safety on the road.

On the other hand, the Chevy Silverado stands out for its exceptional fuel economy and impressive uphill performance, proving to be a solid option for those who value efficiency alongside capability. With a mixing of agility and stable braking performance, it caters well to long-distance towing needs.

Meanwhile, the Ram 1500 offers a robust towing capacity but comes with slightly less favorable fuel efficiency, making it suitable for users who require heavy-duty performance without overemphasizing fuel consumption.

As you consider which model aligns best with your needs, reflect on how these key factors—including towing capacity, fuel economy, and braking efficiency—can influence your purchasing decision. Ultimately, each of these trucks brings unique strengths to the table, empowering consumers to find the perfect fit for their towing requirements.

User Adoption Data Summary: Ford F-150, Chevy Silverado, and Ram 1500

Recent data highlights the fierce competition and adoption trends concerning the Ford F-150, Chevy Silverado, and Ram 1500, focusing on popularity, market shares, and user satisfaction metrics.

-

Ford F-150:

- Popularity: The Ford F-150 remains the most popular truck model, thanks in part to its high configurability which appeals to a wide range of consumers.

- Market Share: It consistently ranks first in the light-duty truck segment, with strong sales contributing to its leading market position.

- User Satisfaction: The model scores highly for various configurations and features but struggles with comparably high ownership costs.

-

Chevy Silverado:

- Popularity: In 2024, the Silverado recorded over 560,000 units sold, indicating robust demand and a solid market stance.

- Market Share: Positioned as a more affordable alternative to the F-150, its competitive pricing strategy appeals to budget-conscious consumers.

- User Satisfaction: Users value advanced driver-assistance technologies, though higher overall costs for ownership can impact satisfaction ratings.

-

Ram 1500:

- Popularity: The Ram 1500, while not as dominant as its Ford and Chevy counterparts, fosters a loyal consumer base.

- Market Share: It successfully captures a niche within the heavy-duty market, emphasizing its towing capabilities.

- User Satisfaction: Customers appreciate its design and performance; however, competing fuel efficiency continues to be a concern.

In conclusion, competition among these models highlights diverse strengths in market share, ownership costs, and customer preferences. As users weigh their options, the distinct advantages each truck offers will undoubtedly shape their purchasing decisions.

For more comprehensive insights, visit the following articles:

Ford F-150 Overview,

Chevy Silverado Alternative,

and

Ownership Costs Analysis.

User Adoption Data Summary: Ford F-150, Chevy Silverado, and Ram 1500

Recent data highlights the fierce competition and adoption trends concerning the Ford F-150, Chevy Silverado, and Ram 1500, focusing on popularity, market shares, and user satisfaction metrics.

-

Ford F-150:

-

Popularity: The Ford F-150 remains the most popular truck model, thanks in part to its high configurability which appeals to a wide range of consumers.

Ford F-150 Leads U.S. Pickup Sales with Strong 2025 Performance -

Market Share: It consistently ranks first in the light-duty truck segment, with strong sales contributing to its leading market position. In 2023, the F-150 sold 653,957 units, continuing its dominance in the market for over forty years.

Global and U.S. Sales Rankings for Full-Size Pickups - User Satisfaction: The model scores highly for various configurations and features but struggles with comparably high ownership costs.

-

Popularity: The Ford F-150 remains the most popular truck model, thanks in part to its high configurability which appeals to a wide range of consumers.

-

Chevy Silverado:

-

Popularity: In 2024, the Silverado recorded over 560,000 units sold, indicating robust demand and a solid market stance.

Chevrolet Silverado and Ram 1500 Market Share Trends - Market Share: Positioned as a more affordable alternative to the F-150, its competitive pricing strategy appeals to budget-conscious consumers.

- User Satisfaction: Users value advanced driver-assistance technologies; however, higher overall costs for ownership can impact satisfaction ratings.

-

Popularity: In 2024, the Silverado recorded over 560,000 units sold, indicating robust demand and a solid market stance.

-

Ram 1500:

- Popularity: The Ram 1500, while not as dominant as its Ford and Chevy counterparts, fosters a loyal consumer base.

- Market Share: It successfully captures a niche within the heavy-duty market, emphasizing its towing capabilities. It sold 468,344 units in 2024.

- User Satisfaction: Customers appreciate its design and performance; however, competing fuel efficiency continues to be a concern.

In summary, competition among these models highlights diverse strengths in market share, ownership costs, and customer preferences. The distinct advantages of each truck will undoubtedly shape user purchasing decisions.

For further insights, refer to

NHTSA Reports

and

CarandDriver Analysis.

Key Consumer Demographics

Understanding the demographics of half-ton truck buyers reveals insightful trends that can significantly influence purchasing decisions.

In 2023, the average age of a half-ton truck buyer is around 53 years old, with a median household income of $120,000. The buyer profile is predominantly male, with approximately 85% identifying as male, although there has been a slight increase in female buyers, now accounting for 15% of the market, particularly in segments like the Ram 1500.

Significantly, lifestyle factors play a large role in motivating purchases, with 65% of buyers utilizing their trucks for towing and recreational activities, while 45% engage in home improvement projects. Furthermore, about 70% consider their truck as their daily driver. This diverse use highlights the need for vehicles like the Ford F-150, Chevy Silverado, and Ram 1500 to balance capability and comfort to cater to various consumer needs.