The towing truck market is a unique labyrinth where several variables intertwine, impacting prices significantly. For local auto repair shops, car dealerships, property managers and resort operators, and commercial fleet operators, knowing how much to expect when investing in a towing truck is crucial. This exploration begins with a current market analysis, diving into the factors that influence the pricing. We’ll unravel the types and specifications of towing trucks that affect costs, and finally, we will gaze into the future trends shaping this industry. By connecting every chapter, we aim to provide insights that empower your purchasing decisions, ensuring you’re well-equipped for the demands of your business.

Tow-Scale Economics: Navigating the Price Landscape and Purpose of Modern Tow Trucks

Across the towing industry, trucks arrive in a broad spectrum of scales, configurations, and capabilities, and the price tag moves with them. As of early 2026, buyers encounter a market where a single truck can fall anywhere within a wide envelope, depending on size, towing capacity, and the specific configuration chosen for the job. The core story is not only about sticker price; it is also about how a fleet’s daily demands, risk profile, and long-term maintenance plans shape the true cost of ownership. When we map the landscape in front of a business or municipal fleet, the first step is to translate a need into a capability, then attach a price to that capability that reflects both the upfront investment and the ongoing expenses that accompany it. In practical terms, this means recognizing that light-duty, urban-oriented tow trucks designed for roadside assistance look and act very different from heavy-duty recovery machines built to lift, cradle, and transport substantial weight across long distances. The market has responded to these demands with a spectrum of models, each priced to match the balance of power, efficiency, and durability it offers.

One of the most striking truths about pricing is the correlation between capacity and cost. A heavy, 50-ton-class road recovery vehicle, built to endure the rigors of large-scale incidents, typically commands a broad price range. In the current market, a unit of this class can be found anywhere from the mid-30s thousand to the upper-end of six figures in rare, heavily optioned configurations. The wide spread reflects not only the core lifting capacity but also the optional winch power, the quality of the crane, the complexity of the hydraulic systems, the robustness of the chassis, and the level of customization a buyer requests. At the other end of the spectrum, light-duty options enter the market at markedly lower price points. A four-ton flatbed wrecker, which is well-suited to urban road rescues and incidents in dense traffic, often starts around the mid-teens when purchased in bulk. The same category can escalate quickly if one requests a hydraulic flatbed, a more powerful drive configuration, or upgraded safety features that protect both the operator and the vehicle during loading and unloading.

Beyond these extremes, the mid-range category tends to form the most practical anchor for many fleets. A 10-ton wrecker with a crane—designed for medium- to heavy-recovery tasks—typically prices in a modest new-vehicle band, say around thirty thousand to thirty-six thousand dollars. This bracket reflects a balance: a capable winch, a folding or straight-arm crane, and a robust but economical engine choice designed to handle frequent use without breaking the bank. The 4×2 drive layout common to many of these mid-range trucks keeps initial costs manageable while still delivering reliable performance in routine operations. Then there are specialized configurations—such as 5-ton to 8-ton hydraulic winch tow trucks—that occupy a distinct niche. These are widely used for standard roadside assistance and lighter recovery work, and they tend to sit in a narrow price corridor, often in the high twenty-thousands to just under thirty thousand per unit, depending on the exact winch rating, crane options, and body construction.

To illustrate how these numbers translate into real options, consider several representative pricing examples drawn from current market listings. A light, car-carrier flatbed wrecker with a modest load rating can be found in a range from roughly $18,800 up to $39,990 per unit, a spread that reflects differences in body length, engine power, and the degree of customization. This model is typically intended for light- to medium-duty recovery work, including passenger cars and smaller vehicles where a flatbed is preferred to avoid further scrapes or chassis damage. For buyers seeking a heavier capability, the market offers a flatbed wrecker designed to carry more demanding loads, including urban-to-suburban heavy traffic rescue scenarios. The cost for such a platform can vary by features but often sits in a higher tier, underscoring the premium that flatbed technology and precise alignment bring to safe towing.

Another concrete data point centers on a light-duty, under-lift flatbed wrecker that can be configured with a range of engine outputs—sometimes from mid-range to high-performance levels. In practical terms, this means buyers can choose power options that better align with the expected duty cycle or with the need to haul heavier vehicles quickly after an incident. While the base price remains accessible, the options tree grows with horsepower and crane capability, nudging the total cost upward as the operator demands more aggressive performance. In the same price neighborhood, there are 5- to 8-ton hydraulic-winched units—workhorse tools for everyday roadside rescue—where the price can hover in the mid to high twenty-thousands range, depending on whether the package includes additional safety features, extended reach, or a more robust mounting system for the winch and cradle.

What all these numbers add up to is a market that rewards alignment between need and specification. The cost of ownership extends far beyond the initial invoice. For fleets that rely on towing trucks as critical assets in emergency response, service reliability, uptime, and the ability to minimize vehicle damage during towing are central to the financial calculus. Flatbed configurations, for example, have gained traction not merely for their gentler treatment of towed vehicles but also for the potential to reduce accidental damage during loading and unloading. This safety advantage translates into lower maintenance and claim costs over time, which can partially offset the higher upfront price. As buyers look at the market, they should be prepared to weigh these long-term considerations alongside the initial outlay.

In practical market terms, the breadth of options means price is rarely a simple function of one or two features. It is a composite equation that includes the chassis platform, engine power, transmission alignment, and whether the unit is configured for a 4×2 or another drive layout. The winch system—its pulling power, line speed, and rope type—can add a substantial premium if a fleet foresees frequent heavy recoveries. The crane’s capacity and reach matter, especially for incidents that require lifting and stabilizing vehicles in uneven terrain or on elevated road surfaces. The bed length and construction quality will affect both payload and resistance to wear, and the overall safety systems—from reverse cameras to load-sensing hydraulics—contribute to the cost but also to long-term durability and operator safety.

The geographic location of buyers also plays a critical role. Tariffs, shipping costs, local taxes, and the presence or absence of a nearby service network can all push the delivered price up or down. It’s not unusual for buyers in certain regions to see modest price differentials simply due to logistics and the availability of trained mechanics who understand the specific model and its maintenance requirements. The pricing picture becomes even more complicated when buyers consider customization—whether for specialized recoveries, island or coastal operations, or rescue scenarios that require unique mounting hardware or safety enclosures. In practice, many buyers discover that the most economical price per ton emerges when the unit is tailored to actual duty cycles, rather than when it is outfitted with the maximum possible features by default.

These observations lead to a practical framework for assessing value. A fundamental question remains: what kinds of services will the fleet routinely perform, and what is the typical weight of vehicles to be recovered? If the primary task is urban roadway support for light vehicles and small pickups, a light- to mid-range flatbed with adequate crane capacity may offer the best balance of cost and capability. For fleets that encounter heavier payloads or longer recovery operations, a higher-capacity crane or a more robust winch may be essential, even if it carries a higher price tag. In markets where non-damaging towing is a priority, flatbeds are increasingly the preferred option, and buyers may accept a higher upfront cost because the downstream savings—in fewer vehicle damages, fewer liability claims, and extended vehicle life—can be substantial.

Buyers should also consider the logistics of procurement. Many listings show a minimum order quantity of one unit, but bulk purchases can yield a lower per-unit price. This is especially relevant for municipal or fleet buyers that plan to refresh or expand a small fleet over a multi-year period. The market’s segmentation is clear: basic recovery options come at accessible prices, while high-performance vehicles with flatbed technology command premium pricing. Yet the premium often includes benefits that matter for fleet operations—precision control, greater protection for towed vehicles, better operator safety, and improved reliability in demanding environments. The market is increasingly oriented toward safety-driven adoption, with flatbed capabilities gaining traction as the preferred option in contexts where the risk of vehicle damage is a critical concern.

For potential buyers seeking real-time guidance, the crucial next step is to obtain current pricing and availability directly from suppliers and dealers who can tailor quotes to the exact engine power, winch type, crane specifications, and bed options desired. In this regard, the market nods to the importance of direct communication with suppliers, who can translate a fleet’s operating profile into a customized package. The dynamic nature of pricing—shaped by production runs, raw material costs, and currency fluctuations—means that students of the market should expect to refresh price quotes as part of a strategic purchasing process. If readers want to explore related discussions on fleet composition and emergency readiness, a broader look at fleet management and preparedness strategies is worth a consult. See The Island Tow Truck Blog for deeper context on fleet planning and emergency-readiness considerations: The Island Tow Truck Blog.

In the realm of market data and ongoing learning, prospective buyers should not rely on a single data point. The landscape is shaped by multiple configurations, regional availability, and the evolving set of capabilities that modern tow trucks bring to the job. The best-informed purchasing decisions emerge from a careful synthesis of duty cycle assessment, cost of ownership modeling, and supplier conversations that surface real-world performance expectations. As a practical takeaway, a buyer should start with a clear picture of daily demand—how many recoveries, what average weight, typical terrain, and the desired balance between speed and gentleness in vehicle handling. With those inputs, the price is better understood not as a fixed barrier but as a function of value: what the vehicle can protect, how it can improve uptime, and how it aligns with long-term capital planning.

The broader market narrative also carries a curiously simple insight: the upgrading of capacity and safety features tends to be aspirational for many operators, yet the most impactful savings often come from the mid-range workhorse that can reliably handle the majority of tasks without excessive idle time or maintenance cost. This reality underscores a pattern seen across fleets large and small—the most effective investment is not always the one with the highest horsepower or the longest crane, but the option that best fits the typical mix of incidents, vehicle weights, and geographic conditions a fleet faces day to day. In this sense, the price map is less about chasing the most expensive spec and more about aligning a truck’s capabilities with the actual emergency-response tempo. For readers seeking a deeper dive into broader topics—ranging from general towing operations to emergency-response planning—refer to industry discussions and guidance at The Island Tow Truck Blog for additional perspectives on fleet composition and readiness: The Island Tow Truck Blog.

External resource: For a concrete listing and specifications that illustrate the range discussed above, see the external industry listing describing a 50-ton heavy recovery vehicle and related configurations: https://www.alibaba.com/product-detail/Sinotruk-HOWO-50t-Road-Recovery-Vehicle_1600755724874.html

What Determines Tow Truck Price: The Technical, Market, and Regulatory Drivers Behind ‘How Much Is a Towing Truck’

Understanding the price of a towing truck means reading a complex map of design choices, market forces, and legal costs. Every figure you see in a quote reflects combinations of measurable vehicle features and shifting external factors. Across the full spectrum—from light urban flatbeds to heavy road-recovery wreckers—the same core drivers reappear. This chapter walks through those drivers in a single, connected narrative so you can judge offers with practical clarity.

Start with the truck itself. Size, towing capacity, and engine power form the backbone of price. A larger chassis and stronger frame need thicker steel, reinforced welds, and heavier axles. Those parts cost more to source and to assemble. Increased gross vehicle weight (GVW) means larger brakes, stronger suspensions, and heavier-duty drivetrains. Each of those subsystems adds material and labor cost, and the cumulative effect is usually non-linear: doubling towing capacity often increases cost more than twofold.

Engine choice is another direct lever on price. Higher horsepower engines use more advanced fuel systems, higher-grade materials, and often more expensive emissions controls. They require stronger transmissions and cooling systems. Buyers who plan to haul heavy loads or operate on steep terrain end up paying for that engineering. Conversely, light-duty trucks with modest engines will be cheaper to purchase and operate, but they limit what the operator can legally and safely tow.

Configuration and equipment choices transform a basic chassis into a working towing truck. A hydraulic flatbed, a wheel-lift, a heavy-duty boom, or an integrated crane each brings its own cost profile. Hydraulic systems require pumps, valves, and reinforced mounting points. Winches vary in rated pull, line capacity, and drum construction; choosing a higher-rated winch means thicker cable, stronger winch housings, and often more sophisticated control electronics. Specialty items—remote controls, integrated lighting, and weatherproofing—add incremental cost. When these components are combined and certified as a system, labor to fit, test, and warranty the installation raises the final price.

Material grades and component quality separate budget machines from durable investment pieces. Premium brake systems, air suspension, and heavy-duty tires cost more but reduce downtime and extend service life. Electronics for driver comfort and safety—such as advanced braking aids, stability controls, or ergonomic cabs—also move price upward. Some buyers reduce upfront cost by selecting simpler interiors and fewer driver aids. That lowers sticker price, but operating costs can be higher over the truck’s life when repair bills and downtime are counted.

Brand and manufacturer reputation weigh heavily on what you pay. Established manufacturers invest in research and development, field testing, and dealer support networks. Those investments raise upfront cost but often translate into lower long-term risk. Buyers pay a premium for assurances: parts availability, training, and warranty coverage. Newer or lesser-known makers may undercut price by streamlining features or by sourcing lower-cost components. Their value can be compelling for cash-strapped buyers, but total cost of ownership may rise if parts are scarce or failures occur more often.

Market dynamics and macroeconomic conditions overlay technical choices. When demand for towing trucks increases, manufacturers may face order backlogs and raise prices. Supply chain disruptions, like shortages of semiconductors or steel, change component costs quickly. Raw material price swings move through to finished prices, often with a lag. Interest rates matter for fleet buyers. Higher financing costs increase monthly payments. That can make a technically superior truck unaffordable on a given budget, shifting buyer preference toward cheaper, lower-spec options.

Geography and purchase channel influence the final number. Buying directly from a manufacturer may cut dealer markups. However, direct purchases sometimes require larger minimum orders, and delivery times can be long. Dealers offer convenience, immediate availability, and local support. They add margins to cover inventory and service. Regional differences in labor costs, taxes, and import duties also create price variance. Trucks sold into regions with high import tariffs or strict emissions rules typically carry higher sticker prices to cover compliance and logistics.

Importing a towing truck brings additional line items. Tariffs, customs duties, port handling fees, and inland transport must be considered. Local taxes such as VAT or consumption tax add to the buyer’s outlay. In many markets, these costs can add a substantial percentage to the factory price. Buyers who compare offers should obtain a fully landed cost estimate rather than only an ex-factory price. That prevents budget surprises and ensures apples-to-apples comparisons between local and imported options.

Regulatory requirements have become a major and growing cost driver. Emissions regulations require manufacturers to fit exhaust after-treatment systems and redesign engines. These technologies increase purchase price and sometimes reduce fuel tolerance for lower-quality fuels. Safety standards impose structural and electronic upgrades. New rules around occupant protection, lighting, or braking systems mean that a truck built for one market might require modifications for another. Manufacturers pass the cost of engineering compliance on to buyers.

Operational needs change how value is measured. A municipality buying recovery trucks for 24/7 incident response will prioritize uptime, parts support, and proven durability. That buyer typically pays more for a trusted brand with a strong service footprint. A small roadside assistance operator might prefer lower capital cost and higher fleet turnover. Understanding expected duty cycle, utilization rates, and local terrain helps match specification to value and avoid overpaying for unnecessary capability.

Customization and optional packages are where buyers exercise the most control. A baseline chassis can be upfitted to meet almost any requirement, but every option increases cost. Remote-controlled winches, longer booms, reinforced decks, and specialty lighting are common choices. Many suppliers bundle options into packages, which can be cost-effective. Buyers should calculate whether each option reduces operational costs or simply increases up-front expense. Some options pay back quickly through improved safety or reduced repair bills. Others are luxury add-ons that lengthen depreciation schedules.

After-sales support, warranty terms, and lifecycle costs shape perceived value. A higher initial price followed by reliable service and long warranty coverage can result in a lower total cost of ownership. Warranty terms vary in length and scope. Some manufacturers include powertrain and chassis coverage, while others limit warranty to basic defects. Service network density affects downtime. If parts must be shipped internationally, repair times lengthen, increasing indirect costs and reducing fleet availability. A slightly higher purchase price with strong local service can be the economical choice for high-utilization fleets.

Financing and resale value are subtle but important price influencers. Financing terms alter how much a truck costs over time. Leasing options can lower upfront capital needs but add long-term payments. Residual values depend on brand reputation, market demand, and maintenance history. Trucks from well-known manufacturers typically have better resale values. That matters when planning fleet replacement cycles and calculating depreciation. A higher initial price may be offset by stronger resale proceeds.

Finally, market timing and strategy matter. Buying in a down market can capture lower prices and faster delivery. Conversely, urgent needs during peak seasons often require paying premiums. Group purchasing or fleet consolidation can achieve volume discounts. Conversely, bespoke one-off builds rarely receive the same price advantages and typically cost more. Smart buyers plan purchasing cycles, align procurement with fleet strategy, and avoid last-minute purchases when possible.

For operators seeking practical next steps, compare offers using total cost of ownership as the primary metric. Request fully itemized quotes that separate chassis, upfit, shipping, taxes, and warranty. Ask about lead times and parts availability. Evaluate financing scenarios, and estimate resale value under multiple usage patterns. If you manage a fleet with emergency response responsibilities, integrate procurement decisions with operational plans and training. That alignment reduces the risk of paying for capability you won’t need. For practical guidance on aligning fleet purchases with response needs, see essential fleet emergency response strategies.

As a concrete reference, suppliers list a wide range of available configurations and price points on marketplace listings, which can illustrate how technical choices map to price. Example heavy-duty wrecker listing: https://www.alibaba.com/product-detail/Sinotruk-HOWO-50t-Road-Recovery-Vehicle_1600755724874.html

Driven by Power and Design: How Lifting Capacity, Boom Architecture, and Bed Type Drive Tow Truck Costs

A tow truck is rarely bought for a single, simple job. It is a highly engineered tool whose price reflects a bundle of capabilities, design choices, and long-term expectations. When buyers ask, how much is a towing truck?, they are really asking: what combination of lifting power, reach, reliability, and payload flexibility will deliver the most value for the tasks at hand? The answer mirrors the job profile more than the sticker price. The costs are driven by four core dimensions: lifting capacity, boom design, bed or platform configuration, and the intended use case. Each of these dimensions interacts with material quality, hydraulic systems, and control sophistication to determine the upfront cost, ongoing maintenance, and total cost of ownership. As you walk through the market snapshots and hypothetical configurations, the pattern becomes clear: bigger is not always better for every operation, but in the contexts where large recoveries and difficult terrain are routine, higher capacity and more capable architecture are almost always worth the premium.

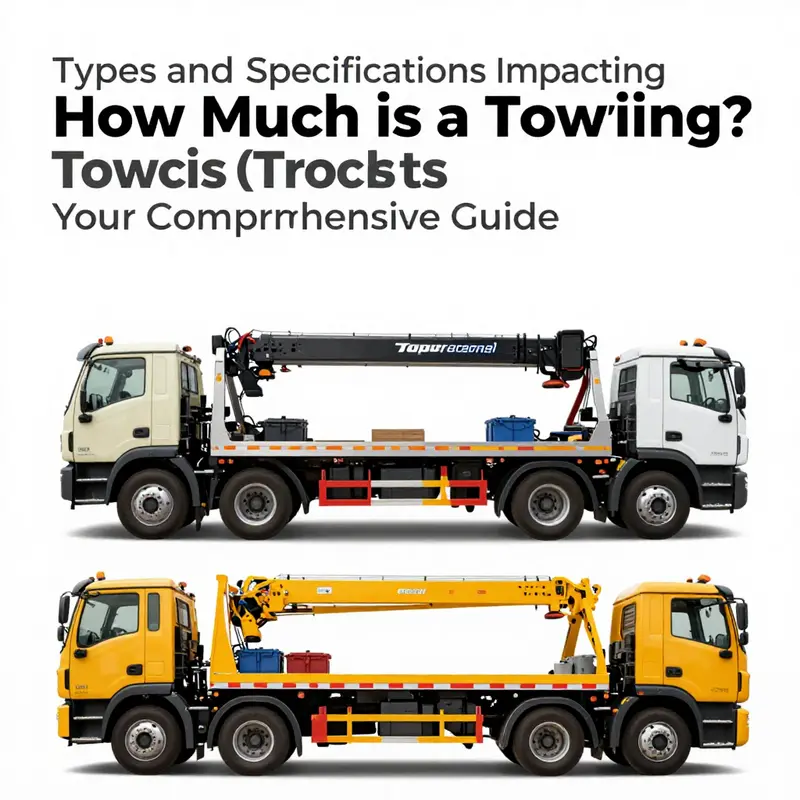

Lifting capacity sits at the heart of the cost equation. In the world of towing and recovery, the scale ranges from light-duty units designed for quick roadside assistance to heavy-duty behemoths built for highway incidents, industrial sites, or remote locations. For a 4-ton or roughly light-to-medium duty setup, the frame must still be robust enough to handle a flatbed or a compact wrecker role, and the hydraulic systems must be precise for controlled deployment and recovery. This tier typically carries a significantly lower price tag compared with the heavy-duty end of the spectrum. Move up to 30 tons and beyond, and you shift into a family of machines that require reinforced chassis members, higher-grade steel, more substantial drivetrain components, and winches with greater pulling capacity. The price climbs not just because of the added metal, but because the engineering tolerance stacks become tighter. High-capacity systems demand stricter quality control, better corrosion protection, and more rigorous testing, all of which contribute to a higher up-front cost and, over the long run, to better uptime and reduced risk of failure during critical operations.

Boom design is the second major driver of cost. The boom is more than a lifting arm; it is the working heart of the recovery operation. Its geometry—whether it is a folding or a fixed, telescoping configuration—determines how far a unit can reach, how much load can be safely extended over a vehicle, and how much room there is for maneuvering in constrained spaces. In specialized contexts, the boom must meet exacting material standards and bespoke fabrication requirements that push prices upward. For example, an airport or aircraft-assist model may require extra stiffness, vibration resistance, and non-sparking hardware in certain components. These requirements ripple into the bill of materials, quality assurance processes, and ultimately the purchase price. A standard urban or highway recovery unit might emphasize a balance of reach and rigidity, with a design that supports quick setup and reliable operation in a city corridor or highway shoulder. Those tradeoffs influence not just the initial price but the durability and maintenance profile in service.

The bed or platform configuration plays a crucial role in both function and cost. Flatbeds, valued for securing and transporting operable or immobilized vehicles, carry structural complexity that adds to the price. They must withstand repeated loading cycles, resist bending under load, and allow for smooth, precise loading and unloading. The added complexity of a flatbed—paired with a robust hydraulic system to tilt, retract, or slide—translates into higher manufacturing costs and a longer build time. Built-in booms, on the other hand, contribute structural integrity and streamlined hydraulic plumbing, but they often appear in premium models, where rugged efficiency and reliability justify a higher upfront expense. In contrast, traditional slide-in or conventional wrecker configurations may deliver lower initial costs but come with tradeoffs in load securing, time-to-load, and versatility in certain recovery scenarios. The bed design, therefore, is a tangible representation of how a machine is expected to operate, and its cost reflects that intent.

Intended use case weaves through every other factor. A unit optimized for urban towing and roadside assistance tends to prioritize fast hook-ups, easy maneuverability, and efficient loading times. It may favor a lighter frame and a more streamlined hydraulic system to minimize fuel consumption and service intervals in city fleets. By contrast, a unit designed for off-road rescues or challenging terrain often relies on reinforced chassis components, greater ground clearance, more capable steering, and perhaps all-terrain tires or suspension upgrades. These choices drive not only the upfront cost but the long-term operational costs, including maintenance frequency, downtime, and parts availability in rugged environments. In aerospace-adjacent or heavy industrial settings, you might find specialized hydraulics, corrosion-resistant materials, and extended reach that push the price higher yet yield a cost of ownership that makes sense for mission-critical work.

To ground this discussion in market context, it helps to translate these specifications into typical price bands, recognizing that bulk orders and customization options push numbers up or down. Light-duty, 4-ton flatbeds or equivalent light-wrecker configurations, often sold to urban fleets or contractors who need reliable short-haul recovery, can start around the mid-teens of thousands in bulk purchases. The bulk discount mindset is important because manufacturers frequently offer substantial price reductions when orders involve multiple units or standardized configurations. This is where early planning and fleet strategy intersect with budgeting: a multi-vehicle purchase can bring unit costs down, but you should also consider the total cost of ownership, not just the upfront price.

Moving into the 5- to 8-ton category, which is commonly deployed for standard roadside assistance, prices commonly land in the mid to upper $20k range. These units typically feature hydraulic winches and compact booms suitable for routine on-scene operations, with enough capacity to handle most passenger cars and light trucks. The design emphasis remains on reliability, ease of maintenance, and quick readiness for service. While the sticker price is higher than the light-duty end, the operational flexibility—combined with efficiency gains in loading and transport—often translates into favorable lifecycle costs for fleets that tally high daily usage.

At the next rung, around 10 tons and with a crane integrated or available, a common price band falls roughly in the $30k to $36k territory. This class balances reach, lift, and control sophistication with a reasonable footprint for urban and semi-urban deployment. The inclusion of a crane expands what the vehicle can handle on-site, such as vehicle derangements where lifting gear is advantageous or where the operator must reposition a vehicle or lift it into a transport bed without separate lifting apparatus. The crane adds a layer of mechanical versatility but also adds maintenance complexity and potential downtime if hydraulic lines or articulations require service.

For truly heavy-duty operations—think highway recoveries, industrial site incidents, or multiple-vehicle incidents in more demanding environments—the market shows a broader and more varied ceiling. Hefty, 30-ton and beyond units command higher prices as the build becomes more specialized. In many markets, 30-ton-plus wreckers carry prices that reflect reinforced frame structures, high-capacity winches, hardened components, and extended wear parts designed for intensive use. The higher price is not simply a premium for raw power; it is a reflection of the engineering that keeps these machines performing reliably under heavy loads, often in challenging weather and on unforgiving roads.

One striking takeaway from the available market benchmarks is that the price landscape is not uniform. It is shaped by how the vendor packages the core capabilities—lifting capacity, boom geometry, bed design, and control systems—with the operation profile. The same essential task—recovering a disabled vehicle—can be approached with very different equipment configurations that deliver distinct values. A fleet that prioritizes rapid roadside response may favor faster hook-ups and lighter weight with efficient flatbeds, accepting some tradeoffs in maximum lift. A fleet that handles advanced recoveries or commercial vehicle incidents may invest in higher lifting capacity and more robust booms, accepting higher upfront costs and longer lead times in exchange for greater on-site versatility and resilience.

Policy and procurement considerations also shape the final price a buyer experiences. Vehicle regulations, regional maintenance standards, and the cost of training operators to run specialized equipment all feed into the long-run cost of ownership. For example, a unit with a high-capacity hydraulic system demands careful operator training to maximize efficiency and minimize wear. The investment in training and safety compliance, while not always included in the sticker price, is a real financial factor for any fleet planning. A thorough procurement approach recognizes that a lower upfront price can translate into higher ongoing costs if maintenance becomes frequent or downtime rises due to insufficient operator proficiency or suboptimal configuration choices. Conversely, a higher initial investment in a more capable unit can yield lower downtime and better uptime availability, especially for fleets that rely on timely recovery work as a core service.

For readers seeking a quick sense of current market examples, the literature on tow-truck specifications notes that light-duty options can be viable around the lower end of the spectrum with bulk discounts, while mid-range to heavy-duty configurations demand careful alignment of performance goals with the investment. In practice, buyers should map the expected workload, typical recovery scenarios, and service locations to a specification plan that prioritizes the most impactful capabilities first. The goal is to achieve a configuration where the lift capacity, reach, and bed design align with real-world needs without paying for capabilities that will sit idle. In other words, the value of a tow truck lies not only in its maximum capacity or its longest reach, but in how well its architecture matches the fleet’s actual operations.

For practitioners exploring broader context and practical decision-making around towing equipment specifications, there is a wealth of guidance available in industry-minded resources. The Island Tow Truck blog offers practical, field-tested perspectives that can help frame fleet decisions and operational priorities. See The Island Tow Truck blog for more on how fleets approach equipment choices in real-world settings. https://theislandtowtruck.com/blog/

In sum, the cost of a towing truck is a function of purposeful design more than a single attribute. Lifting capacity determines what the machine can attempt; the boom design dictates how safely and efficiently it can reach and maneuver; bed configuration affects load security and loading speed; and the intended use case binds all these elements into a single value proposition. Entering the market with a clear picture of expected recovery scenarios, terrain, and service locations helps ensure the selected specifications deliver the best balance of upfront cost and long-run performance. Buyers should pursue a thoughtful mix of robust engineering, reliability, and maintainability, choosing options that minimize downtime and maximize mission readiness. Customization should be pursued judiciously, with a clear line-of-sight to the tasks the fleet plans to perform and the conditions in which those tasks will be executed.

For those who want a deeper dive into specifications and benchmarking, see the broader guide issued by industry analysts, which provides up-to-date comparisons across bed configurations, crane capabilities, and hydraulic systems. External resource: https://www.madisonhill.com/tow-truck-specifications

Tow-Tightening Forecasts: Why Tow Truck Costs Are Rising and What That Means for the Road Ahead

Tow costs are driven by more than distance or crew size. They reflect equipment upgrades, skilled operators, regulatory demands, and new technologies. As fleets grow and recoveries become more complex, the value and cost of a tow expand to cover high capacity winches, stabilizing gear, GPS and telematics, and faster on scene service. Labor shortages push wage pressures higher, while automation and data systems improve productivity over time. In summary, pricing moves with the mix of hardware, people, and policy, not just miles towed.

Final thoughts

Understanding how much is a towing truck goes beyond mere numbers; it’s about grasping the value these vehicles bring to your business operations. Throughout the analysis, we’ve seen how current market trends, influencing factors, and specifications intertwine to shape pricing. By staying informed about future trends, you can make strategic decisions that align with your operational goals. Choose wisely, and let your investment in a towing truck drive your business forward effectively and efficiently.