In recent years, the U.S. has seen significant regulatory shifts that have the potential to reshape entire industries. One of the most impactful changes is President Trump’s declaration of a 25% tariff on heavy trucks not built in the U.S. This bold move, aimed at protecting American manufacturers, raises concerns for island transportation businesses that heavily depend on imported vehicles.

As Trump stated, “In order to protect our Great Heavy Truck Manufacturers from unfair outside competition, I will be imposing… a 25% Tariff on all ‘Heavy (Big!) Trucks’ made in other parts of the World.”

The consequences of this tariff will echo throughout the transportation sector, affecting not only the cost of doing business but also the viability of operations for those island firms that lack access to domestic truck manufacturing. Understanding these implications is essential for stakeholders in the transportation realm as they navigate this new landscape.

Regulatory Background

In October 2025, President Donald Trump announced a significant regulatory change: the imposition of a 25% tariff on heavy trucks not manufactured in the United States, effective November 1, 2025. This measure is part of a broader strategy to boost domestic manufacturing and address national security concerns related to foreign-produced vehicles and components. The American Trucking Associations anticipates that the average cost of a Class 8 truck could surge by approximately $30,000 due to these tariffs, straining the budgets of businesses that rely on these vehicles, particularly in island economies.

For local businesses, this tariff could lead to increased vehicle acquisition costs, compelling operators to extend the life of older trucks, which may be less efficient and incur higher maintenance costs. Additionally, the limited availability of domestic heavy-duty truck options makes it challenging for island businesses to source suitable vehicles for their operations. Furthermore, established supply chains may be disrupted as companies face delays in vehicle procurement and parts availability, hampering their ability to adapt to this new regulatory environment.

The economic implications are significant; the Perryman Group predicts that sustained tariffs can lead to job reductions and decreased sales within affected sectors. Such outcomes are particularly concerning for island businesses that operate with constrained resources and fewer alternatives. Overall, the introduction of the 25% tariff on heavy trucks represents a critical shift in the regulatory landscape, posing challenges that island transportation businesses must navigate to maintain their viability.

Analysis of Stakeholder Response

The recent announcement of a 25% tariff on heavy trucks by President Trump has triggered a wave of responses from significant stakeholders in the trucking industry, particularly from Peter Voorhoeve, President of Volvo Trucks North America, and Chris Spear, President of the American Trucking Associations (ATA). Their insights offer a glimpse into the operational challenges that local businesses and the trucking industry face as a result of these tariffs.

Peter Voorhoeve’s Insights:

Voorhoeve has expressed trepidation regarding the potential job losses resulting from the tariffs. In April 2025, Volvo made the difficult decision to lay off between 550 to 800 employees at its U.S. facilities, a move attributed to declining demand and increased production costs, highlighting how tariffs can have direct implications for employment within the industry. The layoffs affected key locations such as Mack Trucks in Macungie, Pennsylvania, and Volvo facilities in Dublin, Virginia, and Hagerstown, Maryland. These cuts signify a broader trend where manufacturers are struggling to adjust to both rising costs and reduced demand, positioning them precariously in a challenging economic landscape. Source: Reuters

Chris Spear’s Assessment:

Chris Spear has been vocal about the operational ramifications posed by the tariffs. He points out that a 25% tariff on imports from Mexico could surge the price of a new Class 8 truck by up to $35,000. Such drastic price increases are particularly burdensome for small carriers and could escalate operational costs for larger fleets significantly, further complicating their financial landscape. Spear warns that these tariffs might dampen freight volumes, as increased costs for consumers could lead to reduced demand for goods transported by trucks. He emphasizes that the trucking industry, which is integral to moving 85% of goods across the southern border and 67% across the northern border, could face severe challenges due to rising operational costs and declining demand. Source: American Trucking Associations

Impact on Local Businesses:

The cascading effects of these tariffs extend beyond the trucking industry to local businesses that heavily depend on transport services. Increased acquisition costs for equipment and potential supply chain disruptions are anticipated to strain local businesses, compounding their operational challenges. A broad survey highlighted that 90% of U.S. business owners are concerned about potential supply chain disruptions caused by these tariffs, with a staggering 72% identifying cyberattacks as a significant risk moving forward. Source: Reuters

In summary, both Voorhoeve and Spear underscore the need for a careful assessment of the tariffs’ implications on employment, operational costs, and overall industry recovery, raising critical questions about the long-term viability of local businesses in an environment constrained by tariff-induced challenges.

User Adoption Data on Island Transportation Businesses

As of October 30, 2025, island transportation businesses are actively strategizing to adapt to the impending 25% tariff on imported medium- and heavy-duty trucks, which is set to take effect on November 1, 2025. This regulatory change aims to bolster domestic truck manufacturing by imposing a 25% duty on imported vehicles and parts.

Strategies and Adaptations:

- Diversifying Supply Chains: Companies are exploring alternative suppliers and considering domestic manufacturers to mitigate tariff impact. This shift aims to reduce reliance on imported vehicles and parts, thus avoiding additional costs associated with the new duties.

- Extending Vehicle Lifecycles: To defer the need for new, tariff-impacted purchases, businesses are maintaining and operating their existing fleets longer. This approach helps manage costs while awaiting potential market stabilization.

- Investing in Domestic Manufacturing: Some companies, such as Volvo Group, are considering investments in domestic production facilities to circumvent tariffs. Volvo is proceeding with a $700 million project to construct a truck factory in Monterrey, which is expected to begin operations in 2026.

Challenges Faced:

- Increased Operational Costs: The American Trucking Associations (ATA) estimates that a Class 8 tractor’s price could increase by over $30,000 due to the tariffs, posing challenges for businesses with thin profit margins.

- Supply Chain Disruptions: Existing supply chains may be disrupted, especially for firms relying on imported trucks and parts, necessitating rapid adjustments in their procurement strategies.

- Market Uncertainty: The introduction of tariffs has created market uncertainty, affecting demand and complicating long-term planning for transportation businesses.

Industry Responses:

- Advocacy and Lobbying: Industry groups, including the ATA, are engaging policymakers for relief from the tariffs. They emphasize the potential negative impact on the trucking sector and the broader economy.

- Operational Adjustments: Companies are reassessing their operational strategies, including route planning and fleet composition, to adapt to the changing economic landscape.

In summary, island transportation businesses are employing a combination of supply chain diversification, investment in domestic manufacturing, and operational adjustments to navigate the challenges posed by the new 25% tariff on imported heavy trucks. The industry closely monitors developments and advocates for measures supporting sustainable operations.

Comparison of Major Truck Vendors Affected by the Tariff

| Company Name | Market Share | Estimated Impact of Tariff |

|---|---|---|

| Peterbilt | 17% | Significant increase in vehicle prices and reduced sales due to costlier imports. |

| Kenworth | 15% | Anticipated rise in Class 8 truck prices by approximately $30,000, affecting sales. |

| Freightliner | 25% | Major effect with increased operational costs for buyers likely leading to reduced demand. |

| Mack Trucks | 8% | Increased costs expected to constrain market presence and demand. |

| Volvo | 10% | Plans to expand domestic production amidst rising costs. |

| Paccar | 12% | Likely to benefit from reduced competition among importing manufacturers. |

| Mack Trucks | 8% | Facing challenges in maintaining current market levels amid rising costs. |

This table highlights key truck vendors impacted by the recent tariff, showing not only their market share but also the anticipated consequences of the tariff on their operations. Understanding these impacts can aid industry stakeholders in strategizing for the challenges brought on by the tariff changes.

Concluding Thoughts

The introduction of a 25% tariff on heavy trucks not built in the U.S. marks a significant turning point for island transportation and local economies. As discussed, this regulatory change carries real implications, primarily through increased vehicle costs and operational challenges for businesses reliant on imported vehicles. The strain on financial resources may force many operators to extend the life of aging fleets, leading to diminished efficiency and higher maintenance expenses.

In the long term, these tariffs could hinder economic growth within island communities, amplifying costs and limiting access to essential transportation for goods and services. It is crucial for business leaders to proactively respond to these changes by diversifying procurement strategies and exploring domestic manufacturing partnerships, as seen with initiatives like Volvo’s plans to establish a truck factory in Monterrey.

The time to act is now. Stakeholders must advocate for policies that consider the unique challenges faced by island transporters while exploring innovative logistical solutions. Collaboration with industry organizations can facilitate discussions around potential exemptions or assistance programs to alleviate the burdens imposed by these tariffs. Furthermore, staying informed and adaptable will be key in navigating this evolving landscape. Business leaders should not only prepare for immediate impacts but also strategize for a sustainable future that embraces opportunities amid regulatory challenges.

In conclusion, the landscape of island transportation is shifting, and it is imperative for local businesses to position themselves wisely. By anticipating changes, fostering collaborations, and remaining flexible, stakeholders can not only survive but thrive in this new era of regulatory scrutiny.

Economic Impact of Tariff on Island Economies

The implementation of a 25% tariff on heavy trucks has had significant economic repercussions, particularly affecting island economies and the transportation sector.

Impact on Island Economies:

Island nations, which often rely heavily on imports for their transportation infrastructure, have faced increased costs due to the tariffs. For instance, the American Trucking Associations (ATA) estimated that the 25% tariff could raise the price of a new Class 8 truck by approximately $30,000. This substantial increase poses challenges for businesses in island economies that depend on heavy trucks for logistics and transportation [source].

Job Growth or Loss in the Transportation Sector:

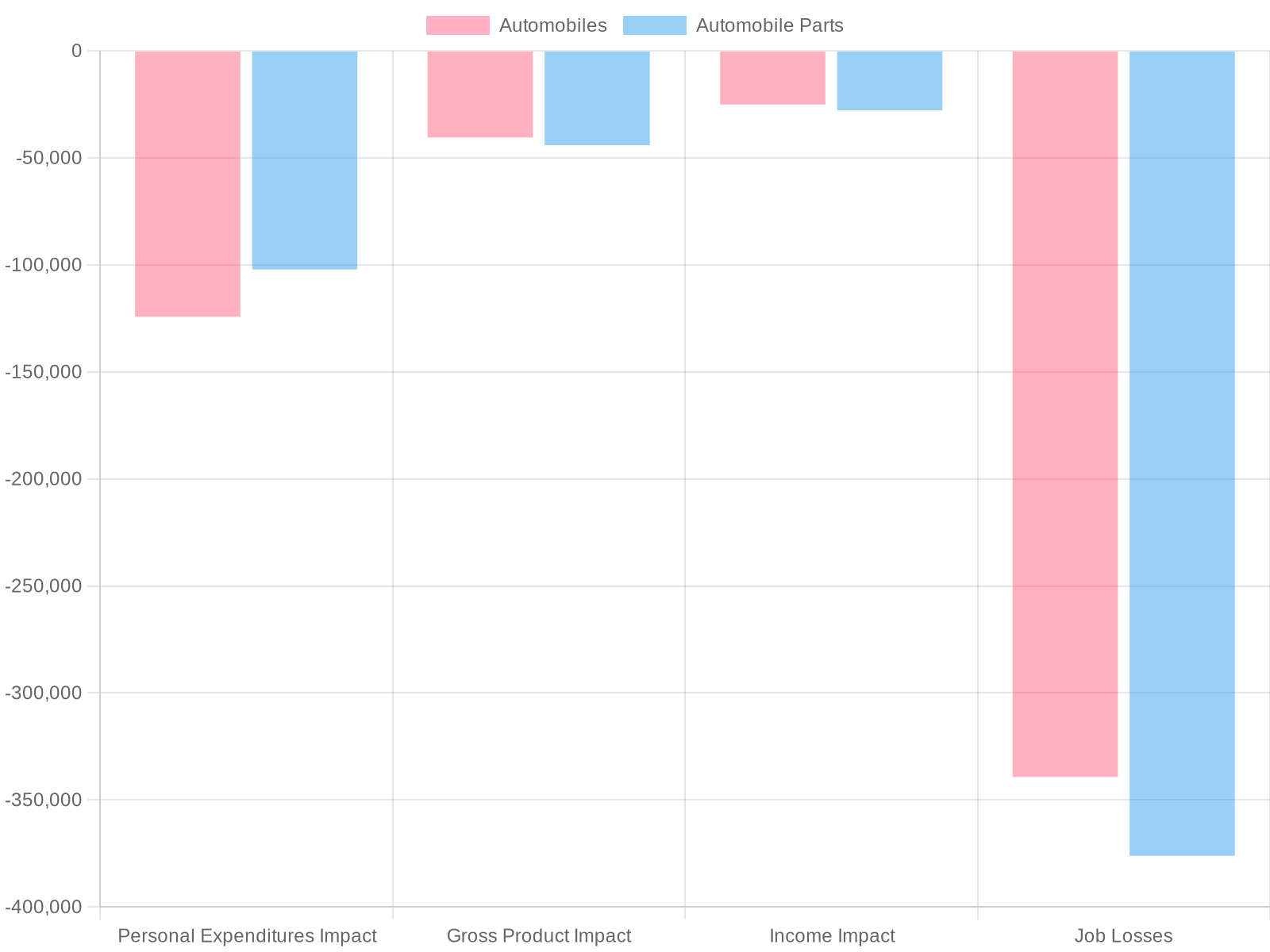

The tariffs have led to job losses in the transportation sector. The Perryman Group estimated that a sustained 25% tariff on automobiles and parts could result in a net loss of approximately 339,300 jobs in the U.S. economy. If automotive parts are also included, the job losses could rise to about 715,400 [source].

Following the tariff implementation, the U.S. trucking industry has experienced a downturn. The American Trucking Associations (ATA) reported that capacity has decreased by over 10% since 2022, with smaller carriers and private fleets reducing operations due to economic pressures and regulatory changes [source].

Examples of Job Growth or Loss in Transportation Sector Due to Tariffs:

- Volvo Group Layoffs: In April 2025, Volvo Group announced plans to lay off between 550 and 800 workers at its U.S. facilities due to market uncertainty influenced by the tariffs. [source]

- Daimler Truck Sales Decline: In the third quarter of 2025, Daimler Truck reported a nearly 40% decline in its North American sales, emphasizing the negative effects of the 25% tariffs on market dynamics. [source]

- Traton’s Sales Decline: Volkswagen’s truck division, Traton, saw a 10% decline in first-quarter sales for 2025. [source]

- U.S. Trucking Employment Trends: The trucking industry experienced a decline of 900 jobs in May 2025, reflecting broader economic impacts resulting from trade-related volatility [source].

In summary, the 25% tariff on heavy trucks has led to increased costs for island economies, job losses in the transportation sector, and a notable reduction in trucking capacity post-implementation. Businesses must evaluate these changes to remain viable in a rapidly evolving economic landscape.

Economic Impact and Visual Representation of the 25% Tariff

The implementation of a 25% tariff on heavy trucks has emerged as a turning point for island economies and the U.S. trucking sector. As businesses attempt to understand the magnitude of this change, visual data can illustrate its economic impact more clearly.

Chart illustrating the projected economic impact of the 25% tariff on automobiles and parts, detailing personal expenditures, gross product impact, income impact, and job losses. View Chart

The chart above showcases various metrics associated with the economic ramifications of the tariff, framed against expected job losses in both the automobile and automobile parts sectors. This data signals a daunting upcoming challenge not just for policymakers but also for local businesses reliant on these trucks for transportation.

An additional image provides a visual context for heavy trucks being utilized in island environments, depicting the direct relevance of tariff impacts on local infrastructure and operations.

This image illustrates heavy trucks being transported on an island, emphasizing the impact of the 25% tariff on local transportation businesses.

Summary of Findings

As noted earlier, the tariffs are projected to increase the costs of new Class 8 trucks significantly, raising their price by as much as $30,000 to $35,000. This burden will not only strain budgets but may also lead businesses to reevaluate their operational strategies as they adapt to a harsher economic landscape. Stakeholders must remain proactive in response to these shifts, focusing on diversification strategies and advocating for policy adjustments that account for the unique challenges faced by island transporters.

Expected job losses, heightened costs, and potential reductions in trucking capacity underscore the urgent need for an informed approach in navigating these turbulent waters.

In conclusion, the visual representation of the impact reinforces the narrative that local economies must prepare for the long-term effects of such tariffs while advocating for supportive measures that lessen their burden.

Quotes and Facts About the 25% Truck Tariff

The recent imposition of a 25% tariff on imported heavy trucks has triggered a variety of responses from industry stakeholders. Here are key quotes and important facts about this tariff:

Key Quotes:

-

President Donald Trump:

“In order to protect our Great Heavy Truck Manufacturers from unfair outside competition, I will be imposing… a 25% Tariff on all ‘Heavy (Big!) Trucks’ made in other parts of the World.”

-

Chris Spear (President, American Trucking Associations):

“As the trucking industry recovers from a years-long freight recession marked by low freight volumes, depressed rates, and rising operational costs, we have concern that tariffs could decrease freight volumes and increase costs for motor carriers at a time when the industry is just beginning to recover.”

-

Economist Arthur Laffer:

“President Donald Trump’s proposed 25% tariffs on auto imports could add $4,711 to the cost of a vehicle, potentially hindering U.S. automakers’ competitiveness.”

-

David Kelleher (Dealership Owner):

“I had sold to a customer, $80,000 truck. It’s $100,000 now. So he’s not going to buy the truck. It’s going to sit on my lot.”

Important Facts:

- A 25% tariff has been imposed on heavy trucks not built in the U.S., effective October 1, 2025.

- This tariff is expected to lead to an increase in the price of a new Class 8 truck by approximately $30,000, according to the American Trucking Associations.

- The tariff aims to protect domestic manufacturers like Peterbilt, Kenworth, and Mack Trucks from foreign competition.

- Increased costs due to the tariff may result in job losses and reduced market activity in the U.S. trucking industry.

These statements and facts encapsulate the concerns and implications surrounding the tariff, as various stakeholders assess its potential impact on costs, employment, and market dynamics.

Introduction: The Impact of Tariffs on Truck Costs

In recent years, the U.S. has seen significant regulatory shifts that have the potential to reshape entire industries. One of the most impactful changes is President Trump’s declaration of a 25% tariff on heavy trucks not built in the U.S. This bold move, aimed at protecting American manufacturers, raises concerns for island transportation businesses that heavily depend on imported vehicles. As Trump stated, “In order to protect our Great Heavy Truck Manufacturers from unfair outside competition, I will be imposing… a 25% Tariff on all ‘Heavy (Big!) Trucks’ made in other parts of the World.” The consequences of this tariff will echo throughout the transportation sector, affecting not only the cost of doing business but also the viability of operations for those island firms that lack access to domestic truck manufacturing. Understanding these implications is essential for stakeholders in the transportation realm as they navigate this new landscape.

Regulatory Background and Transportation Regulations

In October 2025, President Donald Trump announced a significant regulatory change: the imposition of a 25% tariff on heavy trucks not manufactured in the United States, effective November 1, 2025. This measure is part of a broader strategy to boost domestic manufacturing and address national security concerns related to foreign-produced vehicles and components. The American Trucking Associations anticipates that the average cost of a Class 8 truck could surge by approximately $30,000 due to these tariffs, straining the budgets of businesses that rely on these vehicles, particularly in island economies.

For local businesses, this tariff could lead to increased vehicle acquisition costs, compelling operators to extend the life of older trucks, which may be less efficient and incur higher maintenance costs. Additionally, the limited availability of domestic heavy-duty truck options makes it challenging for island businesses to source suitable vehicles for their operations. Furthermore, established supply chains may be disrupted as companies face delays in vehicle procurement and parts availability, hampering their ability to adapt to this new regulatory environment.

The economic implications are significant; the Perryman Group predicts that sustained tariffs can lead to job reductions and decreased sales within affected sectors. Such outcomes are particularly concerning for island businesses that operate with constrained resources and fewer alternatives. Overall, the introduction of the 25% tariff on heavy trucks represents a critical shift in the regulatory landscape, posing challenges that island transportation businesses must navigate to maintain their viability.

Analysis of Stakeholder Response to the Impact of Tariffs on Truck Costs

The recent announcement of a 25% tariff on heavy trucks by President Trump has triggered a wave of responses from significant stakeholders in the trucking industry, particularly from Peter Voorhoeve, President of Volvo Trucks North America, and Chris Spear, President of the American Trucking Associations (ATA). Their insights offer a glimpse into the operational challenges that local businesses and the trucking industry face as a result of these tariffs.

Peter Voorhoeve’s Insights:

Voorhoeve has expressed trepidation regarding the potential job losses resulting from the tariffs. In April 2025, Volvo made the difficult decision to lay off between 550 to 800 employees at its U.S. facilities, a move attributed to declining demand and increased production costs, highlighting how tariffs can have direct implications for employment within the industry. The layoffs affected key locations such as Mack Trucks in Macungie, Pennsylvania, and Volvo facilities in Dublin, Virginia, and Hagerstown, Maryland. These cuts signify a broader trend where manufacturers are struggling to adjust to both rising costs and reduced demand, positioning them precariously in a challenging economic landscape. Source

Chris Spear’s Assessment:

Chris Spear has been vocal about the operational ramifications posed by the tariffs. He points out that a 25% tariff on imports from Mexico could surge the price of a new Class 8 truck by up to $35,000. Such drastic price increases are particularly burdensome for small carriers and could escalate operational costs for larger fleets significantly, further complicating their financial landscape. Spear warns that these tariffs might dampen freight volumes, as increased costs for consumers could lead to reduced demand for goods transported by trucks. He emphasizes that the trucking industry, which is integral to moving 85% of goods across the southern border and 67% across the northern border, could face severe challenges due to rising operational costs and declining demand. Source

Impact on Local Businesses:

The cascading effects of these tariffs extend beyond the trucking industry to local businesses that heavily depend on transport services. Increased acquisition costs for equipment and potential supply chain disruptions are anticipated to strain local businesses, compounding their operational challenges. A broad survey highlighted that 90% of U.S. business owners are concerned about potential supply chain disruptions caused by these tariffs, with a staggering 72% identifying cyberattacks as a significant risk moving forward. Source

In summary, both Voorhoeve and Spear underscore the need for a careful assessment of the tariffs’ implications on employment, operational costs, and overall industry recovery, raising critical questions about the long-term viability of local businesses in an environment constrained by tariff-induced challenges.

User Adoption Data on Island Transportation Businesses

As of October 30, 2025, island transportation businesses are actively strategizing to adapt to the impending 25% tariff on imported medium- and heavy-duty trucks, which is set to take effect on November 1, 2025. This regulatory change aims to bolster domestic truck manufacturing by imposing a 25% duty on imported vehicles and parts.

Strategies and Adaptations:

- Diversifying Supply Chains: Companies are exploring alternative suppliers and considering domestic manufacturers to mitigate the impact of tariffs on truck costs. This shift aims to reduce reliance on imported vehicles and parts, thus avoiding additional costs associated with the new duties.

- Extending Vehicle Lifecycles: To defer the need for new, tariff-impacted purchases, businesses are maintaining and operating their existing fleets longer. This approach helps manage costs while awaiting potential market stabilization.

- Investing in Domestic Manufacturing: Some companies, such as Volvo Group, are considering investments in domestic production facilities to circumvent tariffs. Volvo is proceeding with a $700 million project to construct a truck factory in Monterrey, which is expected to begin operations in 2026.

Challenges Faced:

- Increased Operational Costs: The American Trucking Associations (ATA) estimates that a Class 8 tractor’s price could increase by over $30,000 due to the tariffs, posing challenges for businesses with thin profit margins.

- Supply Chain Disruptions: Existing supply chains may be disrupted, especially for firms relying on imported trucks and parts, necessitating rapid adjustments in their procurement strategies.

- Market Uncertainty: The introduction of tariffs has created market uncertainty, affecting demand and complicating long-term planning for transportation businesses.

Industry Responses:

- Advocacy and Lobbying: Industry groups, including the ATA, are engaging policymakers for relief from the tariffs. They emphasize the potential negative impact on the trucking sector and the broader economy.

- Operational Adjustments: Companies are reassessing their operational strategies, including route planning and fleet composition, to adapt to the changing economic landscape.

In summary, island transportation businesses are employing a combination of supply chain diversification, investment in domestic manufacturing, and operational adjustments to navigate the challenges posed by the new 25% tariff on imported heavy trucks. The industry closely monitors developments and advocates for measures supporting sustainable operations.

Comparison of Affected Vendors by Tariff Changes

| Company Name | Market Share | Estimated Impact of Tariff |

|---|---|---|

| Peterbilt | 17% | Significant increase in vehicle prices and reduced sales due to costlier imports. |

| Kenworth | 15% | Anticipated rise in Class 8 truck prices by approximately $30,000, affecting sales. |

| Freightliner | 25% | Major effect with increased operational costs for buyers likely leading to reduced demand. |

| Mack Trucks | 8% | Increased costs expected to constrain market presence and demand. |

| Volvo | 10% | Plans to expand domestic production amidst rising costs. |

| Paccar | 12% | Likely to benefit from reduced competition among importing manufacturers. |

| Mack Trucks | 8% | Facing challenges in maintaining current market levels amid rising costs. |

This table highlights key truck vendors impacted by the recent tariff, showing not only their market share but also the anticipated consequences of the tariff on their operations. Understanding these impacts can aid industry stakeholders in strategizing for the challenges brought on by the tariff changes.

Concluding Thoughts on Transportation Regulations

The introduction of a 25% tariff on heavy trucks not built in the U.S. marks a significant turning point for island transportation and local economies. As discussed, this regulatory change carries real implications, primarily through increased vehicle costs and operational challenges for businesses reliant on imported vehicles. The strain on financial resources may force many operators to extend the life of aging fleets, leading to diminished efficiency and higher maintenance expenses.

In the long term, these tariffs could hinder economic growth within island communities, amplifying costs and limiting access to essential transportation for goods and services. It is crucial for business leaders to proactively respond to these changes by diversifying procurement strategies and exploring domestic manufacturing partnerships, as seen with initiatives like Volvo’s plans to establish a truck factory in Monterrey.

The time to act is now. Stakeholders must advocate for policies that consider the unique challenges faced by island transporters while exploring innovative logistical solutions. Collaboration with industry organizations can facilitate discussions around potential exemptions or assistance programs to alleviate the burdens imposed by these tariffs. Furthermore, staying informed and adaptable will be key in navigating this evolving landscape. Business leaders should not only prepare for immediate impacts but also strategize for a sustainable future that embraces opportunities amid regulatory challenges.

In conclusion, the landscape of island transportation is shifting, and it is imperative for local businesses to position themselves wisely. By anticipating changes, fostering collaborations, and remaining flexible, stakeholders can not only survive but thrive in this new era of regulatory scrutiny.

Economic Impact of Tariff on Island Economies

The implementation of a 25% tariff on heavy trucks has had significant economic repercussions, particularly affecting island economies and the transportation sector.

Impact on Island Economies:

Island nations, which often rely heavily on imports for their transportation infrastructure, have faced increased costs due to the tariffs. For instance, the American Trucking Associations (ATA) estimated that the 25% tariff could raise the price of a new Class 8 truck by approximately $30,000. This substantial increase poses challenges for businesses in island economies that depend on heavy trucks for logistics and transportation (source).

Job Growth or Loss in the Transportation Sector:

The tariffs have led to job losses in the transportation sector. The Perryman Group estimated that a sustained 25% tariff on automobiles and parts could result in a net loss of approximately 339,300 jobs in the U.S. economy. If automotive parts are also included, the job losses could rise to about 715,400 (source).

Following the tariff implementation, the U.S. trucking industry has experienced a downturn. The American Trucking Associations (ATA) reported that capacity has decreased by over 10% since 2022, with smaller carriers and private fleets reducing operations due to economic pressures and regulatory changes (source).

Examples of Job Growth or Loss in Transportation Sector Due to Tariffs:

- Volvo Group Layoffs: In April 2025, Volvo Group announced plans to lay off between 550 and 800 workers at its U.S. facilities due to market uncertainty influenced by the tariffs. (source)

- Daimler Truck Sales Decline: In the third quarter of 2025, Daimler Truck reported a nearly 40% decline in its North American sales, emphasizing the negative effects of the 25% tariffs on market dynamics. (source)

- Traton’s Sales Decline: Volkswagen’s truck division, Traton, saw a 10% decline in first-quarter sales for 2025. (source)

- U.S. Trucking Employment Trends: The trucking industry experienced a decline of 900 jobs in May 2025, reflecting broader economic impacts resulting from trade-related volatility (source).

In summary, the 25% tariff on heavy trucks has led to increased costs for island economies, job losses in the transportation sector, and a notable reduction in trucking capacity post-implementation. Businesses must evaluate these changes to remain viable in a rapidly evolving economic landscape.

Quotes and Facts About the 25% Truck Tariff

The recent imposition of a 25% tariff on imported heavy trucks has triggered a variety of responses from industry stakeholders. Here are key quotes and important facts about this tariff:

Key Quotes:

- President Donald Trump: “In order to protect our Great Heavy Truck Manufacturers from unfair outside competition, I will be imposing… a 25% Tariff on all ‘Heavy (Big!) Trucks’ made in other parts of the World.”

- Chris Spear (President, American Trucking Associations): “As the trucking industry recovers from a years-long freight recession marked by low freight volumes, depressed rates, and rising operational costs, we have concern that tariffs could decrease freight volumes and increase costs for motor carriers at a time when the industry is just beginning to recover.”

- Economist Arthur Laffer: “President Donald Trump’s proposed 25% tariffs on auto imports could add $4,711 to the cost of a vehicle, potentially hindering U.S. automakers’ competitiveness.”

- David Kelleher (Dealership Owner): “I had sold to a customer, $80,000 truck. It’s $100,000 now. So he’s not going to buy the truck. It’s going to sit on my lot.”

Important Facts:

- A 25% tariff has been imposed on heavy trucks not built in the U.S., effective October 1, 2025.

- This tariff is expected to lead to an increase in the price of a new Class 8 truck by approximately $30,000, according to the American Trucking Associations.

- The tariff aims to protect domestic manufacturers like Peterbilt, Kenworth, and Mack Trucks from foreign competition.

- Increased costs due to the tariff may result in job losses and reduced market activity in the U.S. trucking industry.

Economic Impact and User Adoption Data of Tariff on Island Transportation Businesses

The implementation of a 25% tariff on heavy trucks has resulted in significant economic repercussions, particularly affecting island economies and the transportation sector. This tariff, effective November 1, 2025, is expected to raise the price of a new Class 8 truck by approximately $30,000, according to the American Trucking Associations. For island nations, which rely heavily on imports for their transportation infrastructure, these increasing costs pose notable challenges for local businesses heavily dependent on heavy trucks for logistics.

Job Growth or Loss in the Transportation Sector:

The tariffs have had direct implications for employment within the transportation sector. The Perryman Group estimates that a sustained 25% tariff on automobiles and parts could result in a net loss of approximately 339,300 jobs in the U.S. economy. This figure could rise to about 715,400 if automotive parts are included. Following the implementation of the tariff, the U.S. trucking industry has experienced a downturn, with capacity decreasing by over 10% since 2022. Smaller carriers and private fleets have reduced operations due to these economic pressures.

- Volvo Group Layoffs: In April 2025, Volvo Group announced plans to lay off between 550 to 800 workers at its U.S. facilities as part of the challenges posed by tariffs.

- Daimler Truck Sales Decline: In the third quarter of 2025, Daimler Truck reported nearly a 40% decline in its North American sales, illustrating the negative effects of tariffs on market dynamics.

- Traton’s 10% Sales Decline: Volkswagen’s truck division saw a 10% decline in first-quarter sales for 2025.

- U.S. Trucking Employment Trends: In May 2025, the industry experienced a decline of 900 jobs, reflecting broader economic impacts resulting from trade-related volatility.

As of October 30, 2025, island transportation businesses are actively strategizing to adapt to these tariffs by diversifying supply chains and investing in domestic manufacturing. Companies are exploring alternative suppliers and extending the lifecycle of existing vehicles to manage costs while navigating tariff impacts.

Strategies and Adaptations:

- Diversifying Supply Chains: Companies are looking for alternative suppliers and considering domestic manufacturers to mitigate the impact of tariffs.

- Extending Vehicle Lifecycles: Many businesses are maintaining their fleets longer, deferring new purchases impacted by tariffs.

- Investing in Domestic Manufacturing: Firms like Volvo Group are planning substantial investments in domestic production to avoid tariffs, with a $700 million project to construct a truck factory in Monterrey expected to begin operations in 2026.

Overall, the economic implications of the tariff are extensive, straining financial resources for island transportation businesses and highlighting the critical need for adaptation strategies to ensure operational viability in a challenging economic landscape.

Outbound Links on Economic Impact and Job Loss Due to Tariffs

In the sections discussing job loss and economic impact, the following authoritative sources provide additional context and substantiate claims about the impact of tariffs on the transportation sector:

-

“Layoff Wave Hits Freight Sector as Nearly 9,000 Jobs Slashed”

Source: FreightWaves

Link: Read More -

“Trade War’s Toll Mounts as Transportation Industry Faces Major Layoffs”

Source: FreightWaves

Link: Read More -

“Tariff Pendulum Drives Market Volatility for Trucking”

Source: Transport Topics

Link: Read More -

“Trucking Reacts to Trump’s Sweeping Tariffs”

Source: Transport Topics

Link: Read More -

“Tariffs Could Reshape North American Supply Chains for Autos, Lumber, Agrifoods”

Source: FreightWaves

Link: Read More

These links provide valuable insights into the broader economic context surrounding jobs and the effectiveness of tariffs on market dynamics and employment in the trucking and transportation sector.