In today’s world, vehicles symbolize more than just a way to get around; they represent freedom, work, and security. However, what happens when that sense of security is suddenly lost? This was the reality for a vehicle owner in Sarnia when they discovered their trailer had been stolen, as reported on September 24, 2025. A truck towing that stolen trailer crashed through a roundabout, causing damage to property and leaving the community shaken. This event highlights the harsh truths vehicle owners face in times of theft or damage. The emotional impact is profound; feelings of violation and loss can complicate recovery efforts.

Victims of vehicle theft often find themselves not just managing practical issues like insurance claims and police reports, but also dealing with the traumatic aftermath. The experience can be overwhelming, even for those who are well-organized. In this article, we will share crucial lessons for vehicle owners dealing with these distressing circumstances, informed by the recovery efforts in Sarnia. Together, we will emphasize the importance of community support and proactive measures to help restore peace of mind during such challenging times.

Immediate Steps After Discovering Your Vehicle is Stolen

Discovering that your vehicle has been stolen can be a shocking and distressing experience. It is crucial for vehicle owners to act swiftly and follow these steps to help minimize losses and ensure proper recovery proceedings:

-

Notify the Police Immediately

As soon as you confirm that your vehicle is missing, contact your local police department. Provide them with all relevant details, including:- License plate number

- Make, model, and year of the vehicle

- Vehicle identification number (VIN)

- Color and any distinguishing marks or features

- Location and circumstances of the theft

Request a copy of the police report and any reference number they provide, as this will be essential for your insurance claim.

-

Document Everything

Record all details related to the theft. Take notes on conversations with law enforcement and any witnesses. This documentation can be critical for legal purposes and insurance processes. -

Notify Your Insurance Company

Contact your vehicle insurance provider to report the theft. You will need to:- Provide the police report number

- Share detailed information about the vehicle

- Discuss your coverage options, including theft coverage and potential deductibles

- Follow their instructions for filing a claim and ask any questions you may have about the process

-

Reach Out to Local Authorities and Communities

Inform nearby law enforcement agencies, community watch programs, and local car enthusiast groups about the theft. Some local groups monitor social media or forums for illicit sales of stolen vehicles and can assist in recovery efforts. -

Utilize Social Media

Post about your stolen vehicle on your social media platforms. Include photos and last known locations. Encourage friends and followers to share the post to widen the search. Local community groups on platforms like Facebook or Nextdoor can also help disseminate your information. -

Check Online Marketplaces

Regularly examine online platforms where stolen vehicles might be sold. Report any suspicious listings that match your vehicle’s description to law enforcement. -

Consider Installing Tracking Devices

After experiencing a theft, consider installing a GPS vehicle tracking system. These devices can help in recovering stolen vehicles rapidly in the future. -

Stay in Touch with Law Enforcement

Maintain communication with the police for updates on your case. Persistence can help keep your case a priority and increase the chances of recovery.

By following these steps, vehicle owners can take proactive measures to address the theft and mitigate potential losses effectively. Additionally, being informed and prepared can assist in the emotional and logistical challenges faced in such distressing situations.

| Region | Required Documents | Processing Time |

|---|---|---|

| North America | Police report, vehicle registration, proof of ownership | 1 to 3 days |

| Europe | Police report, ID, vehicle registration | 1 to 5 days |

| Asia | Police report, ID, vehicle registration | 2 to 7 days |

| Australia | Police report, vehicle registration, proof of ownership | 1 to 3 days |

| South America | Police report, ID, vehicle registration | 2 to 5 days |

| Africa | Police report, ID, vehicle registration | 3 to 10 days |

This table outlines the essential documents and average processing time for reporting a stolen vehicle across various regions. It is beneficial for vehicle owners to be aware of these requirements to ensure a smoother experience in the event of vehicle theft.

Understanding Vehicle Insurance Coverage for Theft and Damage

When it comes to vehicle insurance, many owners are unsure of what their policies cover regarding theft and damage. Vehicle insurance can vary widely based on the type of coverage, the insurer, and local regulations. Understanding the distinctions between the types of coverage available is crucial for vehicle owners, especially those who might own trailers or other specialty vehicles.

Comprehensive Coverage

Comprehensive insurance is a type of coverage that protects against theft and damage to your vehicle not involving a collision. This includes events like vandalism, natural disasters, and theft. In the case of a stolen trailer, comprehensive coverage would typically reimburse you for the value of the trailer if it is not recovered. This does not only apply to the trailer itself but also to any contents within it, as long as they are covered under the terms of the policy.

Collision Coverage

While collision coverage primarily addresses damages resulting from accidents, it is still an essential component of protecting vehicles. If your trailer were to be damaged while attached to a towing vehicle in an accident, collision coverage could help cover repair costs. However, it is important to note that this type of coverage does not cover theft.

Liability Coverage

Liability coverage comes into play if you are found responsible for an accident that damages someone else’s property or injures someone else. This coverage will not cover your own stolen or damaged vehicle but can be valuable when you are causing harm during an accident involving a trailer, ensuring you satisfy legal and financial obligations.

Common Misconceptions

One common misconception is that simply having insurance guarantees coverage for theft and damage. Many policyholders may be unaware that they need specific endorsements or coverage options to fully protect certain assets. For example, while your vehicle insurance may cover personal vehicles, trailers might require additional coverage stipulations. This means it’s crucial for vehicle owners, especially those with trailers, to thoroughly review their policies and consult with their insurer about specific needs and requirements.

Moreover, many believe that theft coverage is universal, which is untrue. Depending on the insurance provider, some may not cover theft in certain areas or under specific conditions (such as if the vehicle was left unlocked). Additionally, others may limit the maximum payout for certain types of stolen property, such as trailers, leading to significant financial losses if these distinctions are not understood.

In conclusion, vehicle insurance can provide essential protection against theft and damage, but intervals exist between different policy types and what they cover. Vehicle owners should regularly review their policies and consult with their insurance representatives to ensure they have the right coverage for their unique situation, especially in cases involving trailers. Being informed and prepared can save vehicle owners from costly surprises when facing theft or damage issues.

Testimonials from Vehicle Owners Facing Theft or Damage

Vehicle owners who have experienced the theft or damage of their vehicles often share deeply emotional insights reflecting the violation and helplessness they feel, coupled with important lessons learned. Here are some testimonials that underscore these experiences:

Stolen Tesla Recovery Story: Owner Shares Emotional Ordeal

Source: Tesla Motors Club Forum (August 15, 2023)

“I felt physically sick – it’s not just a car, it’s my freedom, my work tool, and my safe space. When my Model 3 was stolen from my driveway overnight, I panicked. Thankfully, Tesla’s tracking capabilities led to its recovery within 24 hours, but the emotional trauma lingered long after the vehicle was returned, with minor damage left behind.”

Motorcycle Theft Victim: ‘They Took More Than My Bike’

Source: Motorcycle.com Forums (January 22, 2024)

“The anger and helplessness were overwhelming. I’d put years of love and customization into my Harley Davidson, which was stolen from a secured parking garage. Insurance compensation couldn’t replace the sentimental value and personal touches lost forever. This experience taught me the importance of multiple security layers.”

Construction Trailer Theft: Small Business Owner’s Nightmare

Source: National Insurance Crime Bureau Blog (November 30, 2023)

“This wasn’t just theft – it was an attack on my livelihood. When my equipment trailer was stolen, I lost $80,000 worth of tools, which forced me to halt three projects and lay off two workers. This experience taught me about GPS tracking and the importance of meticulously documenting all equipment for insurance purposes.”

Carjacking Survivor: ‘I’m Still Nervous Getting Into My Car’

Source: CNN (September 12, 2023)

“They pointed a gun at my head and took everything – my car, my purse, my sense of security. Months later, I still check my backseat repeatedly and panic at stoplights. This experience changed my perspective on personal safety and vehicle security; I invested in additional protective measures.”

Classic Car Theft: Generational Legacy Lost

Source: Hemmings Motor News (June 18, 2023)

“It wasn’t just metal and rubber – it was my grandfather’s pride, my father’s memories, and my future plans. When my 1965 Mustang was stolen, the insurance money meant nothing compared to the family history stolen. This experience highlighted the need for specialized classic car security and tracking systems that many owners overlook.”

These testimonials showcase the varied emotional landscapes that vehicle owners traverse when faced with the loss or damage of their vehicles. They serve as poignant reminders of the importance of preventive measures and support systems during such distressing times.

Conclusion

In the face of vehicle theft, damage, or malfunction, preparation and quick response are paramount. This article has highlighted the critical steps vehicle owners must take immediately after discovering that their property has been compromised. From promptly notifying local authorities and documenting all details to contacting insurance providers and utilizing social media for assistance, being proactive can make a significant difference in recovery rates and emotional relief during distressing times.

Moreover, understanding the nuances of vehicle insurance coverage can equip owners with the knowledge necessary to protect their assets effectively. It is vital to know what your policy covers, especially when it comes to theft, as many policyholders may misinterpret their coverage limits. Investigating additional safety measures or technological aids—like GPS tracking systems—can further enhance security and improve the chances of recovering stolen vehicles.

Testimonials from vehicle owners who have faced such predicaments offer poignant insights into the emotional and practical roller coasters of dealing with theft or damage. They underline the necessity of a community response and the implementation of preventive measures. As we’ve seen from the recent incident in Sarnia, where a stolen trailer was recovered thanks to community and police efforts, no one needs to face these challenges alone.

Ultimately, a mindset centered on preparedness and quick action can alleviate the long-lasting impact of vehicle theft or damage. Vehicle owners are encouraged to educate themselves, engage with their communities, and prioritize protective measures to safeguard their valuable assets—because when it comes to theft and damage, being prepared is not just an option; it’s essential for peace of mind and security.

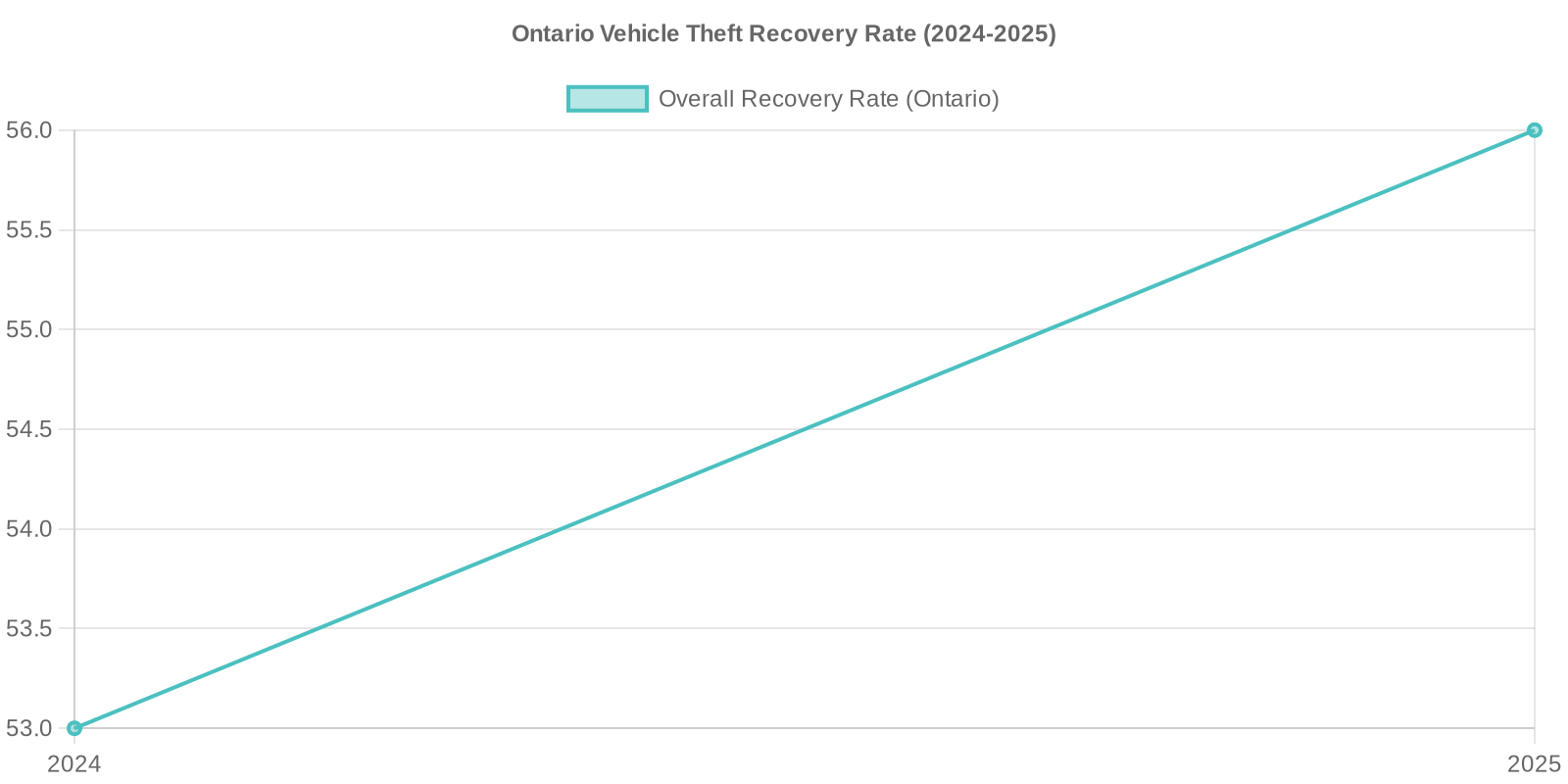

Statistics on Vehicle Theft Recovery Rates in Ontario

In recent years, Ontario has seen a significant focus on combating vehicle theft, yielding noteworthy statistics about vehicle recovery rates. According to a report from the Équité Association, the vehicle theft recovery rate in Canada reached 56% in 2025, an improvement from 53% in the previous year, demonstrating the effectiveness of enhanced collaboration among law enforcement agencies and community initiatives. This increase suggests that owners who quickly report theft may see a significantly higher chance of recovering their stolen vehicles.

Key Findings:

- The Greater Toronto Area (GTA) alone recovered 620 stolen vehicles in 2024. This reflects well on the proactive measures taken by both local law enforcement and public awareness campaigns aimed at encouraging prompt reporting of stolen vehicles.

- The ongoing Canada National Action Plan on Combatting Auto Theft has reported a 19% decrease in overall vehicle thefts in the first half of 2024 compared to the same period last year. While progress continues, theft rates remain elevated compared to historical averages, indicating the persistent threat of organized crime.

- A joint operation named Project Vector resulted in the recovery of 598 stolen vehicles in Montreal, with approximately 75% of these identified as having been stolen from Ontario, highlighting the importance of inter-provincial cooperation in tackling vehicle theft.

- Despite improvements, challenges persist, particularly in urban regions where sophisticated crime techniques are employed, such as altering vehicle identification numbers (VINs) for quick exportation. For instance, the Toronto Police Service recently noted a 34% reduction in auto thefts but also reported a 16% drop in recovery rates, emphasizing the difficulties of securing stolen vehicles swiftly.

These statistics indicate not only the dynamics of vehicle theft in Ontario but also illustrate the crucial role vehicle owners play in reporting thefts promptly. Enhanced public awareness and swift action from vehicle owners positively impact recovery outcomes, which in turn can reduce the overall vehicle theft problem.

Conclusion

The data clearly indicates that taking immediate action following a vehicle theft can dramatically affect the likelihood of recovery. As vehicle theft becomes a more sophisticated issue, owners must stay informed and active in reporting thefts promptly. Collaboratively, law enforcement and the public can make substantial progress in reclaiming stolen vehicles. Continued education on the importance of community involvement in theft prevention and recovery efforts is essential for maintaining safety and security on the roads of Ontario.

This chart illustrates the overall vehicle theft recovery rate in Ontario, showing an increase from 53% in 2024 to 56% in 2025. This upward trend indicates improvements due to enhanced collaboration among law enforcement and community initiatives. Notably, the Greater Toronto Area contributed to these numbers with 620 stolen vehicles recovered in 2024, and ongoing efforts have led to a 19% decrease in vehicle thefts overall.

This data highlights the importance of quick reporting by vehicle owners; those who act swiftly enhance their chances of recovery significantly.

Overall Vehicle Theft Recovery Statistics

- Recovery Rate in Ontario: 56% in 2025

- Recovery Rate in Greater Toronto Area: 620 vehicles in 2024

- Decrease in Overall Vehicle Thefts: 19% in the first half of 2024 compared to the previous year.

Legal Implications of Vehicle Theft for Offenders

Vehicle theft carries significant legal consequences in Canada, as highlighted by the recent incidents in Sarnia. Under Section 333.1 of the Criminal Code, vehicle theft is classified as an indictable offense with a maximum penalty of up to 10 years in prison. For a summary conviction, the penalties can include imprisonment for a term of less than two years and/or a fine of up to $5,000. The severity of the punishment can increase if the theft involves elements such as violence, threats, or connections to organized crime.

In the case of the arrests made during the Sarnia incident, two suspects were charged with theft of a motor vehicle and possession of property obtained by crime. Possession of stolen property is governed by Section 354 of the Criminal Code, which states that the Crown must prove that the accused had possession of stolen goods and knew that they were obtained through criminal means. For property valued over $5,000, the maximum penalty is also 10 years imprisonment, while possession of less valuable stolen property can result in lesser sentences of up to 2 years for summary convictions.

Implications for Repeat Offenders

Repeat offenders can face increasingly harsh sentences. For instance, a Sarnia man was sentenced to 40 months in prison earlier this year for his involvement in multiple vehicle thefts, reflecting the serious implications of engaging in organized theft activities. The court emphasized the need for deterrence and denunciation in cases that indicate a pattern of behavior connected with auto theft, especially when linked to operations targeting high-value vehicles for export or resale.

Moreover, penalties are not just limited to imprisonment. Offenders may face difficulties in securing employment, housing, and other aspects of life post-conviction, complicating their rehabilitation efforts.

Conclusion

The legal landscape regarding vehicle theft is stern, with substantial penalties designed to discourage such crimes. The implications of theft extend beyond immediate legal penalties; they affect the lives of offenders long after their sentences have been served. Understanding these legal consequences is crucial for potential offenders and the wider community to deter future incidents of vehicle theft. The recent arrests related to the Sarnia incident underscore the broader implications of organized crime in auto theft, calling for ongoing vigilance and community awareness to combat these challenges effectively.

Relevant Resources:

- Theft of Motor Vehicle – Government of Canada

- Possession of Property Obtained by Crime

- Sarnia police make arrests in connection to stolen vehicles

- Sentencing for Motor Vehicle Theft in Canada

- Auto Theft and Organized Crime – RCMP

By raising awareness of these legal implications, community members can better understand the consequences of vehicle theft and encourage proactive measures to prevent such crimes.

Call to Action

When faced with the distressing circumstances of vehicle theft, it’s vital to understand that you’re not alone in this journey. As Mark Lobel, a theft recovery expert, notes:

“A stolen vehicle isn’t just metal and glass—it’s someone’s livelihood, their child’s car seat, their sense of security. The emotional devastation hits long before the financial impact. That’s why community vigilance isn’t just helpful; it’s transformative. Every set of eyes watching out for unusual activity becomes part of the recovery chain, turning despair into hope.”

This emphasizes the profound emotional impact of vehicle theft and the essential role that community support plays in recovery efforts. Stay informed, connected, and proactive, because together, we can make a difference in reclaiming peace of mind for all who have been affected by vehicle theft.

In today’s world, vehicles symbolize more than just a way to get around; they represent freedom, work, and security. However, what happens when that sense of security is suddenly lost? This was the reality for a vehicle owner in Sarnia when they discovered their trailer had been stolen, as reported on September 24, 2025. A truck towing that stolen trailer crashed through a roundabout, causing damage to property and leaving the community shaken. This event highlights the harsh truths vehicle owners face in times of theft or damage. The emotional impact is profound; feelings of violation and loss can complicate recovery efforts.

Victims of vehicle theft often find themselves managing practical issues like insurance claims and police reports, while grappling with the emotional aftermath. Understanding vehicle theft prevention tips can significantly help in safeguarding one’s vehicle and enhance a sense of security. In this article, we will share crucial lessons for vehicle owners dealing with these distressing circumstances, informed by the recovery efforts in Sarnia. Together, we will emphasize the importance of community support and proactive measures to help restore peace of mind during such challenging times.

Immediate Steps After Discovering Your Vehicle is Stolen

Discovering that your vehicle has been stolen can be shocking and distressing. It is crucial for vehicle owners to act swiftly and follow these steps to help minimize losses and ensure proper recovery proceedings:

-

Notify the Police Immediately

As soon as you confirm that your vehicle is missing, contact your local police department. Provide them with all relevant details, including:

- License plate number

- Make, model, and year of the vehicle

- Vehicle identification number (VIN)

- Color and any distinguishing marks or features

- Location and circumstances of the theft

Request a copy of the police report and any reference number they provide, as this will be essential for your insurance claim.

-

Document Everything

Record all details related to the theft. Take notes on conversations with law enforcement and any witnesses. This documentation can be critical for legal purposes and insurance processes.

-

Notify Your Insurance Company

Contact your vehicle insurance provider to report the theft. You will need to:

- Provide the police report number

- Share detailed information about the vehicle

- Discuss your coverage options, including theft coverage and potential deductibles

- Follow their instructions for filing a claim and ask any questions you may have about the process

-

Reach Out to Local Authorities and Communities

Inform nearby law enforcement agencies, community watch programs, and local car enthusiast groups about the theft. Some local groups monitor social media or forums for illicit sales of stolen vehicles and can assist in recovery efforts.

-

Utilize Social Media

Post about your stolen vehicle on your social media platforms. Include photos and last known locations. Encourage friends and followers to share the post to widen the search. Local community groups on platforms like Facebook or Nextdoor can also help disseminate your information.

-

Check Online Marketplaces

Regularly examine online platforms where stolen vehicles might be sold. Report any suspicious listings that match your vehicle’s description to law enforcement.

-

Consider Installing Tracking Devices

After experiencing a theft, consider installing a GPS vehicle tracking system, highlighting the GPS tracking benefits. These devices can help in recovering stolen vehicles rapidly in the future, as vehicles equipped with GPS tracking have a 95% recovery rate compared to non-tracked vehicles.

-

Stay in Touch with Law Enforcement

Maintain communication with the police for updates on your case. Persistence can help keep your case a priority and increase the chances of recovery.

By following these steps, vehicle owners can take proactive measures to address the theft and mitigate potential losses effectively. Moreover, implementing simple vehicle theft prevention tips like using visible anti-theft devices can significantly reduce the risk of theft.

Understanding Vehicle Insurance Coverage for Theft and Damage

When it comes to vehicle insurance, many owners are unsure of what their policies cover regarding theft and damage. Vehicle insurance can vary widely based on the type of coverage, the insurer, and local regulations. Understanding the distinctions between the types of coverage available is crucial for vehicle owners, especially those who might own trailers or other specialty vehicles.

Comprehensive Coverage

Comprehensive insurance is a type of coverage that protects against theft and damage to your vehicle not involving a collision. This includes events like vandalism, natural disasters, and theft. In the case of a stolen trailer, comprehensive coverage would typically reimburse you for the value of the trailer if it is not recovered. This does not only apply to the trailer itself but also to any contents within it, as long as they are covered under the terms of the policy.

Collision Coverage

While collision coverage primarily addresses damages resulting from accidents, it is still an essential component of protecting vehicles. If your trailer were to be damaged while attached to a towing vehicle in an accident, collision coverage could help cover repair costs. However, it is important to note that this type of coverage does not cover theft.

Liability Coverage

Liability coverage comes into play if you are found responsible for an accident that damages someone else’s property or injures someone else. This coverage will not cover your own stolen or damaged vehicle but can be valuable when you are causing harm during an accident involving a trailer, ensuring you satisfy legal and financial obligations.

Common Misconceptions

One common misconception is that simply having insurance guarantees coverage for theft and damage. Many policyholders may be unaware that they need specific endorsements or coverage options to fully protect certain assets. For example, while your vehicle insurance may cover personal vehicles, trailers might require additional coverage stipulations. This means it’s crucial for vehicle owners to thoroughly review their policies and consult with their insurer about specific needs and requirements.

Moreover, many believe that theft coverage is universal, which is untrue. Depending on the insurance provider, some may not cover theft in certain areas or under specific conditions (such as if the vehicle was left unlocked). Additionally, others may limit the maximum payout for certain types of stolen property, such as trailers, leading to significant financial losses if these distinctions are not understood.

In conclusion, vehicle insurance can provide essential protection against theft and damage, but intervals exist between different policy types and what they cover. Vehicle owners should regularly review their policies and consult with their insurance representatives to ensure they have the right coverage for their unique situation, especially in cases involving trailers. Being informed and prepared can save vehicle owners from costly surprises when facing theft or damage issues.

Testimonials from Vehicle Owners Facing Theft or Damage

Vehicle owners who have experienced the theft or damage of their vehicles often share deeply emotional insights reflecting the violation and helplessness they feel, coupled with important lessons learned. Here are some testimonials that underscore these experiences:

Stolen Tesla Recovery Story: Owner Shares Emotional Ordeal

Source: Tesla Motors Club Forum (August 15, 2023)

“I felt physically sick – it’s not just a car, it’s my freedom, my work tool, and my safe space. When my Model 3 was stolen from my driveway overnight, I panicked. Thankfully, Tesla’s tracking capabilities led to its recovery within 24 hours, but the emotional trauma lingered long after the vehicle was returned, with minor damage left behind.”

Motorcycle Theft Victim: ‘They Took More Than My Bike’

Source: Motorcycle.com Forums (January 22, 2024)

“The anger and helplessness were overwhelming. I’d put years of love and customization into my Harley Davidson, which was stolen from a secured parking garage. Insurance compensation couldn’t replace the sentimental value and personal touches lost forever. This experience taught me the importance of multiple security layers, particularly GPS tracking benefits for my future vehicles.”

Construction Trailer Theft: Small Business Owner’s Nightmare

Source: National Insurance Crime Bureau Blog (November 30, 2023)

“This wasn’t just theft – it was an attack on my livelihood. When my equipment trailer was stolen, I lost $80,000 worth of tools, which forced me to halt three projects and lay off two workers. This experience taught me about GPS tracking and the importance of meticulously documenting all equipment for insurance purposes.”

These testimonials showcase the varied emotional landscapes that vehicle owners traverse when faced with the loss or damage of their vehicles. They serve as poignant reminders of the importance of preventive measures and support systems during such distressing times.

Conclusion

In the face of vehicle theft, damage, or malfunction, preparation and quick response are paramount. This article has highlighted the critical steps vehicle owners must take immediately after discovering that their property has been compromised. From promptly notifying local authorities and documenting all details to contacting insurance providers and utilizing social media for assistance, being proactive can make a significant difference in recovery rates and emotional relief during distressing times.

Moreover, understanding the nuances of vehicle insurance coverage can equip owners with the knowledge necessary to protect their assets effectively. It is vital to know what your policy covers, especially when it comes to theft, as many policyholders may misinterpret their coverage limits. Investigating additional safety measures or technological aids—like GPS tracking systems—can further enhance security and improve the chances of recovering stolen vehicles.

Ultimately, a mindset centered on preparedness and quick action can alleviate the long-lasting impact of vehicle theft or damage. Vehicle owners are encouraged to educate themselves, engage with their communities, and prioritize protective measures, such as vehicle theft prevention tips, to safeguard their valuable assets—because when it comes to theft and damage, being prepared is not just an option; it’s essential for peace of mind and security.